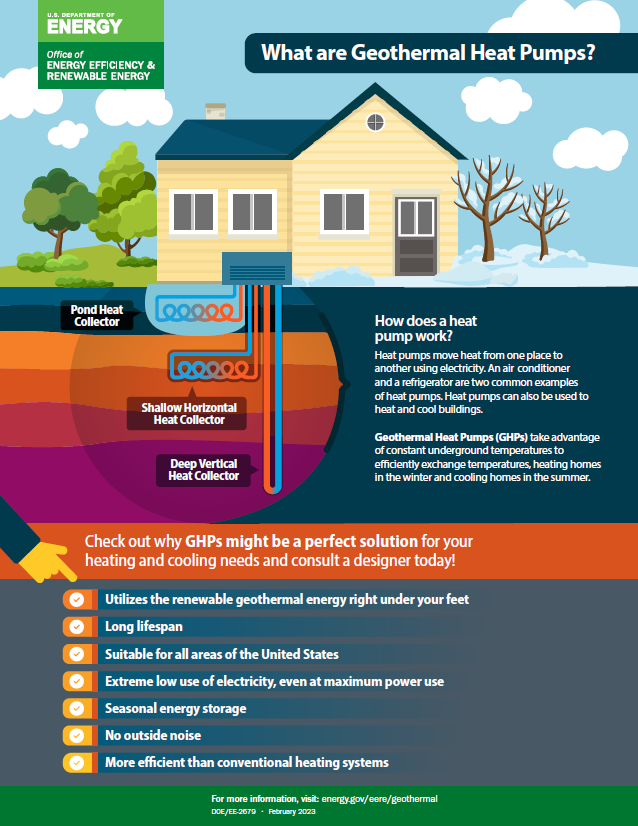

Geothermal heat pumps (GHPs, also known as ground source heat pumps) use the relatively constant temperatures found in the subsurface to warm indoor air in winter and cool it in the summer. Because these constant temperatures can be found nationwide, these systems offer an efficient and low-carbon option to heat and cool homes, businesses, and other buildings in all 50 U.S. states.

Geothermal heat pumps (GHPs) can be added to existing buildings, and tax credits and other financial assistance can make new or retrofitted GHPs more affordable.

Visit the U.S. Department of Energy’s (DOE) Energy Saver Geothermal Heat Pump page for an overview of how geothermal heat pumps work and what the different kinds of GHPS are.

Want a quick guide on how GHPs work?

Download GTO's fact sheet.

Information on Installing Geothermal Heat Pumps

To assess whether your home or business meets the characteristics for installing a geothermal heat pump, contact a geothermal designer (instead of an installer) or a local professional engineer.

The International Ground Source Heat Pump Association and Geothermal Exchange Organization offer searchable directories of designers, installers, and other professionals who can assist you. You can also contact your state energy office or do an internet search for “geothermal heat pump designers/installers in (state)” or something similar.

Homeowner Information

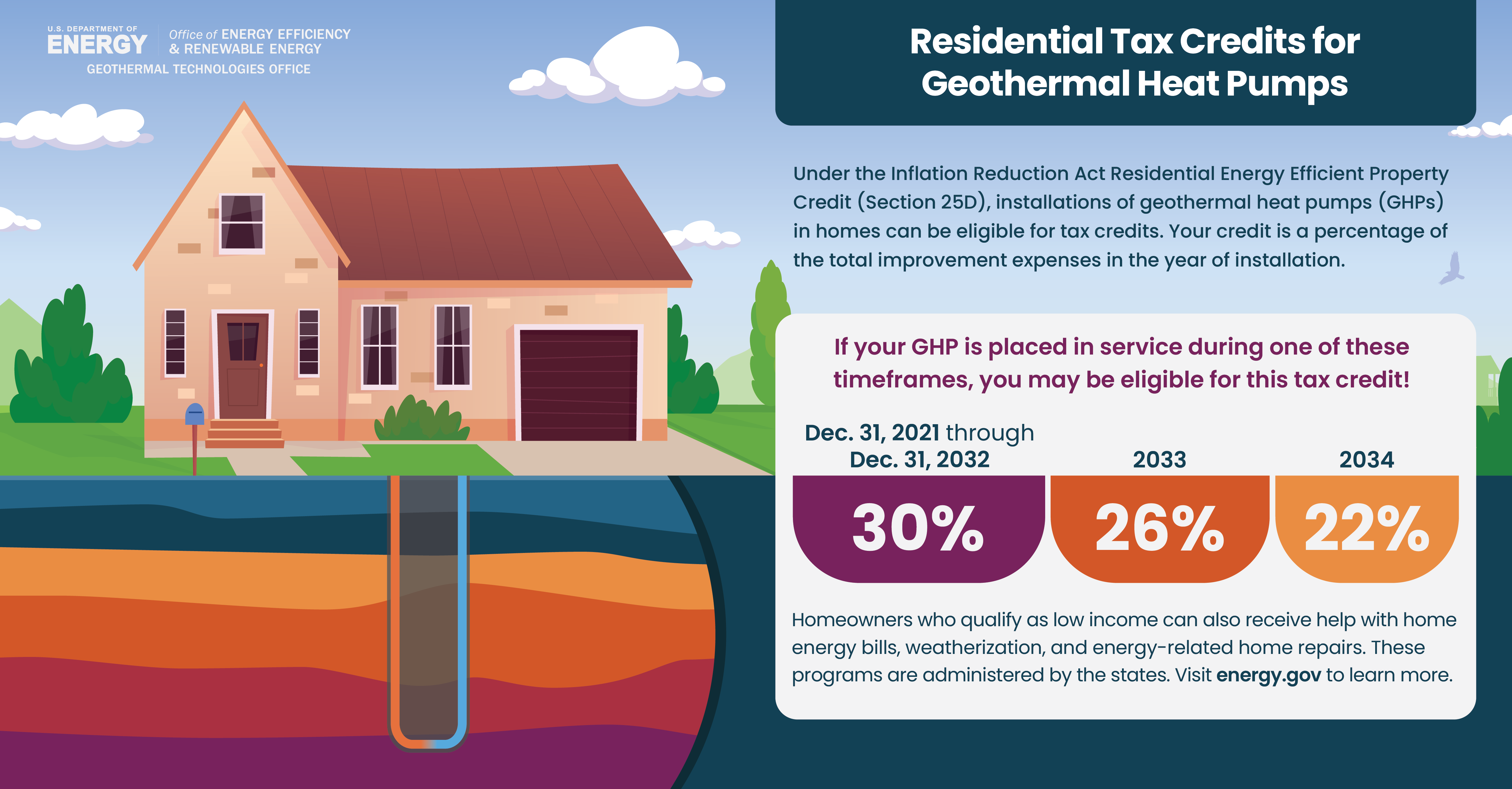

Residential Tax Credits for Geothermal Heat Pumps

Homeowners are eligible for a 30% tax credit under the Inflation Reduction Act (IRA) Residential Energy Efficient Property Credit (Section 25D) for ENERGY STAR-rated GHPs that are in service by Jan. 1, 2033.

The tax credits expire at the end of 2034. The schedule for phasing out the tax credits means that the credit is:

- 30% when your GHP is placed in service after Dec. 31, 2021 and before Jan. 1, 2033.

- 26% when your GHP is placed in service after Dec. 31, 2032 and before Jan. 1, 2034.

- 22% when your GHP is placed in service after Dec. 31, 2033 and before Jan. 1, 2035.

Energy Assistance for Low-Income Homeowners

Homeowners who qualify as low income can also receive help with home energy bills, weatherization, and energy-related home repairs. These programs are administered by the states.

Visit the following sites to learn about eligibility and how to apply for assistance:

- DOE’s Weatherization Assistance Program, which provides assistance with home improvements to improve the efficiency, comfort, health, and safety of homes.

- U.S. Department of Health & Human Services’ Home Energy Assistance Program, which provides assistance with paying home energy bills.

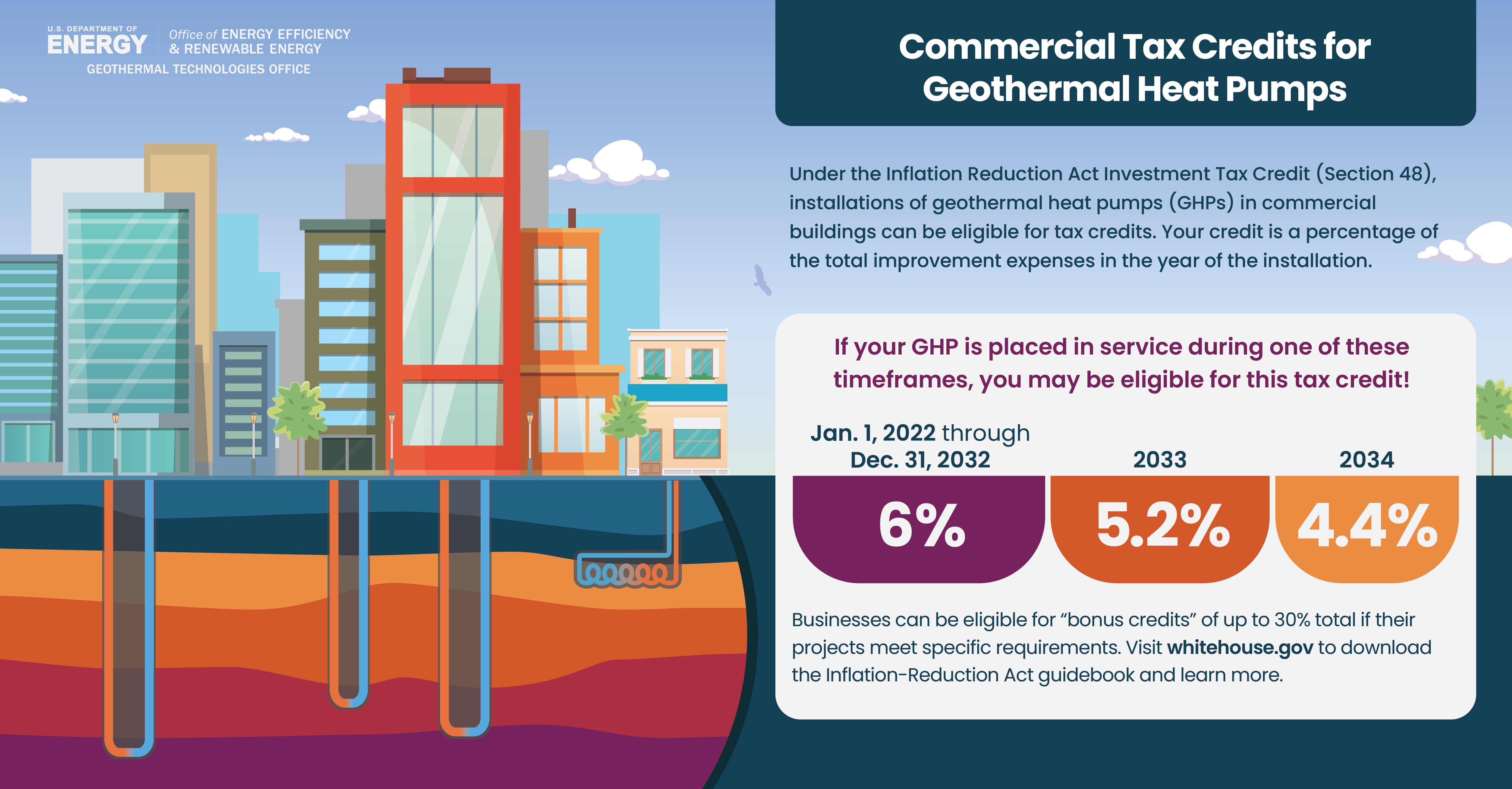

Commercial (Business) Information

Federal tax credits and assistance are intended to encourage upgrading or planning for geothermal heat pump systems in commercial buildings.

A tax professional or local installer can provide more information about specific project eligibility and credits.

Commercial Tax Credits for Geothermal Heat Pumps

Commercial building owners interested in installing GHPs are also eligible for tax credits under the Investment Tax Credit (ITC, Section 48). The base tax credit is 6%, scaling to 5.2% in 2033 and 4.4% in 2034. Businesses are eligible for “bonus credits” of up to 30% total if their projects meet specific prevailing wage, domestic content, or energy community requirements. See page 14 in the White House Guidebook for more information.

Energy Assistance for Agricultural Producers and Rural Small Businesses

Agricultural producers or rural small businesses can consider the U.S. Department of Agriculture’s Rural Energy for America Program, which provides guaranteed loan financing and grant funding for renewable energy systems or energy efficiency improvements.

Local, Utility, and Community Technical Assistance

Local governments, electric utilities, community-based organizations, and others can also apply for 40–60 hours of free technical assistance from DOE’s national laboratory experts on questions related to GHPs via Expert Match, part of DOE’s Communities to Clean Energy program.

Additional Resources

To search for state-level renewable energy incentives, including tax credits, grants, and rebates, visit:

- The Database of State Incentives for Renewables and Efficiency, which provides a centralized resource for renewable energy and energy efficiency policies and incentives. You can search by state or use the USA Summary Tables page to filter for geothermal heat pumps (in the Technology dropdown menu).

- DOE’s State Energy Offices and Organizations page, which provides links for each state’s energy office.

To explore federal tax credits and incentives for low-temperature geothermal technologies, view The Federal Tax Incentives for Low-Temperature Geothermal Technologies document. This resource provides a comprehensive overview of federal incentives that are in place to support greener, more sustainable operations.

To learn more about how geothermal energy can support your local energy and sustainability goals, visit our Community Engagement and Engagement with Tribal and Native Communities pages. Additional resources such as technical assistance, grants, vouchers and other initiatives can be found on the Opportunities of Communities page.

DOE Pathways to Commercial Liftoff report helps pave the way for expanded use of domestic, affordable geothermal heating and cooling.

Check with your local utility, regional renewable energy organizations, and installers to learn about available energy efficiency and renewable energy incentives in your area.

GTO's Work to Expand the Use of Geothermal Energy

The mission of DOE's Geothermal Technologies Office (GTO) mission is to increase geothermal energy deployment through research, development, and demonstration (RD&D) of innovative technologies that enhance exploration and production.

This office is an applied research organization that manages portfolios of RD&D projects selected through competitive funding solicitations.

In partnership with industry, academia, and DOE’s national laboratories, GTO works to expand geothermal development by funding activities in four program areas:

- Enhanced Geothermal Systems

- Hydrothermal Resources

- Low Temperature & Coproduced Resources (including GHPs)

- Data, Modeling, and Analysis

You can learn more about how GTO funds research on our Geothermal Basics page and Open Funding Opportunities page.