Reaching Full Potential: LPO investments across energy storage technologies help ensure clean power is there when it’s needed.

The Department of Energy (DOE) Loan Programs Office (LPO) is working to support deployment of energy storage solutions in the United States to facilitate the transition to a clean energy economy. Accelerated by DOE initiatives, multiple tax credits under the Bipartisan Infrastructure Law and Inflation Reduction Act, and decarbonization goals across the public and private sectors, energy storage will play a key role in the shift to a net-zero economy by 2050.

LPO can finance short and long duration energy storage projects to increase flexibility, stability, resilience, and reliability on a renewables-heavy grid.

Why Energy Storage?

Energy storage serves important grid functions, including time-shifting energy across hours, days, weeks, or months; regulating grid frequency; and ensuring flexibility to balance supply and demand. Energy storage is particularly important in an increasingly electrified world where demand is rising and supply is shifting toward variable renewables, increasing the need for dispatchable energy.

U.S. energy storage capacity will need to scale rapidly over the next two decades to achieve the Biden-Harris Administration’s goal of achieving a net-zero economy by 2050. DOE’s recently published Long Duration Energy Storage (LDES) Liftoff Report found that the U.S. grid may need between 225 and 460 gigawatts of LDES by 2050, requiring $330 billion in capital on the same timeline. These figures are in addition to the nation’s utility scale short duration storage needs, which will be about 160 gigawatts by 2050, according to the reference case from the U.S. Energy Information Administration’s 2023 Annual Energy Outlook.

Energy storage encompasses an array of technologies that enable energy produced at one time, such as during daylight or windy hours, to be stored for later use. LPO can finance commercially ready projects across storage technologies, including flywheels, mechanical technologies, electrochemical technologies, thermal storage, and chemical storage.

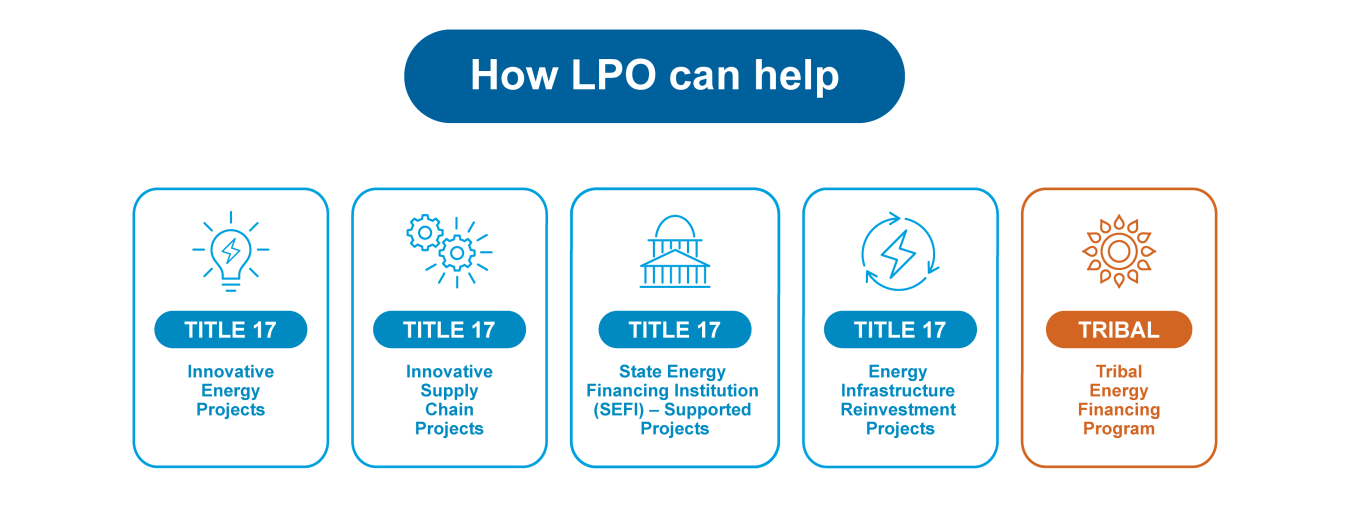

DOE divides energy storage technologies into four categories based on duration of dispatch, each with different primary end uses.

SHORT DURATION |

INTER-DAY LDES |

MULTI-DAY LDES |

SEASONAL SHIFTING |

|

|---|---|---|---|---|

Duration of Dispatch at Maximum Rate before Recharge |

0-10 hours |

10-36 hours |

36-160 hours |

160+ hours |

Storage Technologies |

- Batteries- Flywheels- Some mechanical technologies |

- Most mechanical technologies- Some electrochemical technologies |

- Many thermal technologies- Many electrochemical technologies |

- Chemical storage (e.g., hydrogen) |

Primary End-Use |

Intra-day energy shifting

|

Inter-day shifting |

Resilience for extended power shortfall |

Energy shifting over months |

Adapted from Long Duration Energy Storage - Pathways to Commercial Liftoff

Residential, commercial, industrial, and utility users are beginning to install energy storage systems to fulfill their energy and reliability needs, but challenges remain to deploying these systems at scale. The barriers are as varied as the technologies. Common challenges for the mature technologies LPO focuses on include insufficient supply chains, high manufacturing costs, and lack of debt financing for commercial deployment due to perceived technical risk and unpredictable cash flows in today’s power markets.

LPO can help reduce these barriers by financing early deployments of energy storage technologies and associated supply chains, proving to private lenders that energy storage systems are bankable and accelerating scale up.

Types of Projects LPO Can Finance

LPO can finance projects across technologies and the energy storage value chain that meet eligibility and programmatic requirements.

Projects may include, but are not limited to:

- Manufacturing: Projects that manufacture energy storage systems for a variety of residential, commercial, and utility scale clean energy storage end uses.

- Deployment: Projects that deploy residential, commercial, and utility scale energy storage systems for a variety of clean energy and clean transportation end uses.

Energy Storage Projects in LPO’s Portfolio

-

LPO has offered a conditional commitment to Eos Energy Enterprises, Inc. for an up to $398.6 million loan guarantee for the construction of up to four state-of-the-art production lines to produce the “Eos Z3™".

LPO has offered a conditional commitment to Eos Energy Enterprises, Inc. for an up to $398.6 million loan guarantee for the construction of up to four state-of-the-art production lines to produce the “Eos Z3™". -

LPO has offered a conditional commitment to KORE Power, Inc. for a $850 million loan to help finance the construction of a domestic advanced battery cell manufacturing facility.

LPO has offered a conditional commitment to KORE Power, Inc. for a $850 million loan to help finance the construction of a domestic advanced battery cell manufacturing facility.