This Tech Talk highlights how LPO is working to support deployment of virtual power plants in the United States to facilitate the transition to a clean energy economy.

September 12, 2023The Department of Energy’s (DOE) Loan Programs Office (LPO) is working to support deployment of virtual power plants (VPPs) in the United States to make the U.S. grid more flexible, affordable, clean, and resilient as the economy electrifies.

VPPs are at an inflection point due to market and technical factors, including increased adoption of distributed energy resources, improvements in device software and VPP platforms, and advancements in grid integration software. VPPs will be a key near-term solution to existing energy challenges, including rising costs, interconnection backlogs, peak demand increases, and distribution system congestion.

LPO can finance VPP-related projects to advance equitable clean energy access and support grid flexibility, resilience, and reliability.

Why Virtual Power Plants?

Peak electricity demand is expected to increase for the first time in a decade. At the same time, old coal and gas power plants are retiring. By 2030, the United States will need to add enough new resources to serve approximately 200 GW of peak demand. In the past, grid operators have served rising demand by increasing centralized supply resources, but this will be challenging if transmission interconnections continue to experience multi-year wait times. VPPs present a more efficient alternative to manage this rising demand while making electricity cleaner and more affordable for Americans.

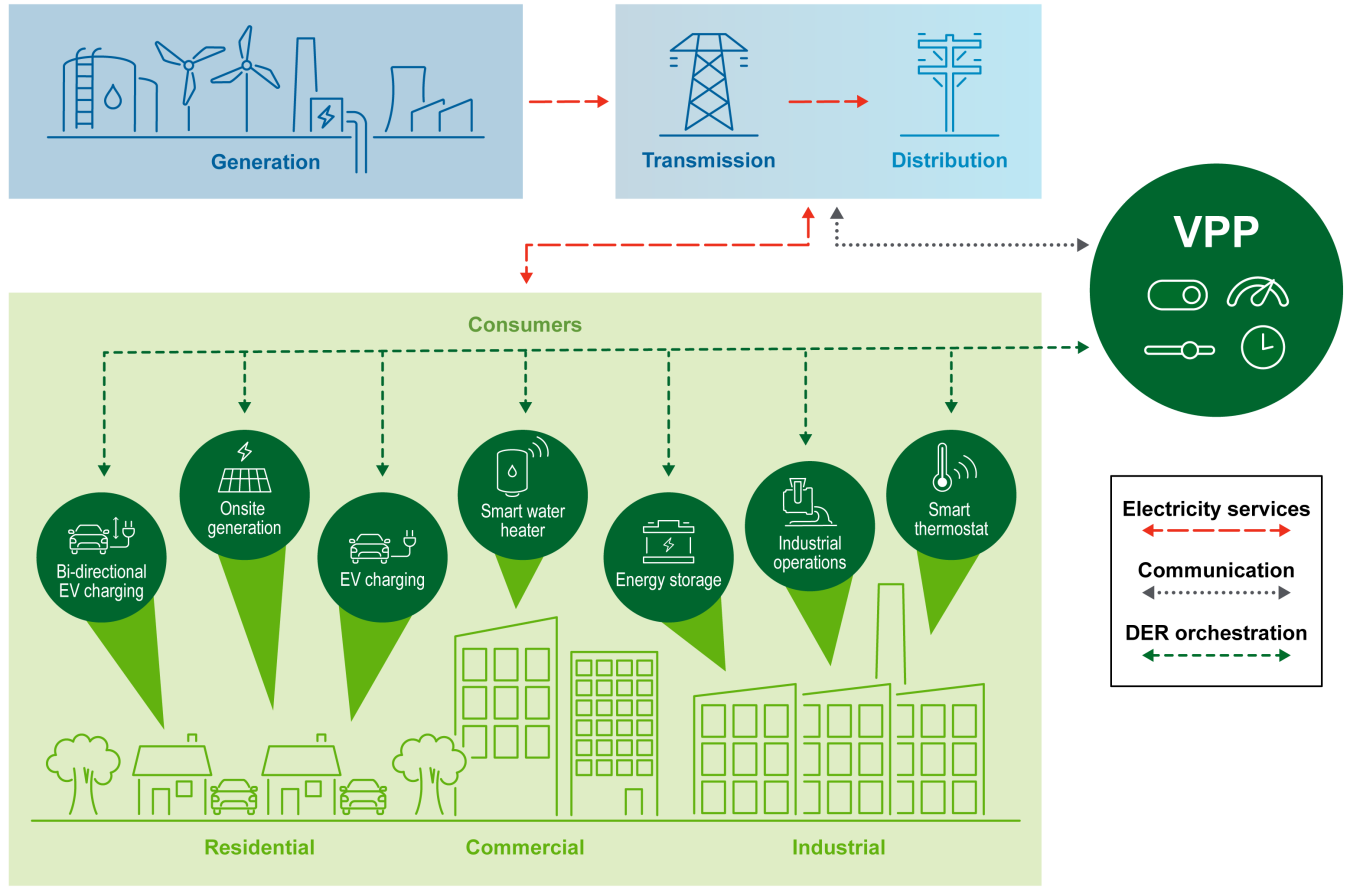

VPPs are aggregations of distributed energy resources (DERs) such as rooftop solar with behind-the-meter batteries, electric vehicles (EVs) and chargers, electric water heaters, smart buildings and their controls, and flexible commercial and industrial loads that can balance electricity demand and supply and provide utility-scale and utility-grade grid services like a traditional power plant. VPPs enroll DER owners—including residential, commercial, and industrial electricity consumers—in a variety of participation models that offer rewards for contributing to efficient grid operations.

Small changes across a few mid-sized loads or hundreds, thousands, or millions of participating household DERs add up to power plant scale. By shifting when participating DERs draw power, for example, VPPs can shave demand peaks and spread energy use more evenly throughout the day. If necessary, they can shed demand from some DERs, like flexible commercial and industrial loads, when the grid is especially strained. Increasingly, VPPs can call on energy sources like behind-the-meter batteries to increase electricity supply on the grid.

There are currently 30-60 GW of VPP capacity on the grid that have been operating with commercially available technology for years. These systems already have a range of capabilities, including time-shifting EV charging to avoid overloading local distribution systems and supplying homes with energy from onsite solar-plus-storage systems during peak hours to reduce demand on the grid.

VPPs present a near-term, low-cost way for grid operators to manage the grid and make electricity more affordable for Americans. Analysis suggests that a VPP made up of residential thermostats, water heaters, EV chargers, and behind-the-meter batteries could provide peaking capacity at roughly half the net cost to a utility of alternatives (e.g., a utility-scale battery and a natural gas peaker plant). Americans who use the grid benefit from cost savings in the form of lower electricity bills, and owners of participating DERs receive further rewards for services provided to the grid.

Tripling the current capacity of VPPs—to 80-160 GW—by 2030 could address 10-20% of peak load and save on the order of $10B in annual grid costs through avoided generation buildout, delayed power infrastructure investments, and reduced operation of expensive peaker plants. Deployment at this scale is possible within the decade. DOE’s recently published VPP Liftoff Report details the market opportunity, current challenges, and potential solutions to get there.

Despite their benefits for American consumers and for advancing the nation’s climate goals, VPPs are often undervalued by grid operators and have yet to scale. Relying on DERs as critical resources is a newer approach to grid management for many operators of distribution and bulk power systems. The tools necessary for grid operators to evaluate, integrate, and compensate VPPs are inconsistent across jurisdictions. Although the innovations across the VPP industry have been valuable, the complexity and fragmentation around how VPPs are implemented has inhibited the growth of VPPs to date.

The federal government is committed to supporting widescale deployment of VPPs that use existing and new technologies to serve an array of grid functions.

- DOE and its collaborators offer more than 20 programs to support VPP-related research, development, demonstration, and deployment. Programs facilitate development of VPP modeling and planning tools, support demonstration projects, offer guidance on grid modernization strategies, provide financing support for DER and VPP deployment, and more.

- The Inflation Reduction Act includes incentives for Americans to purchase VPP-compatible technologies like electric vehicles and smart appliances, laying the groundwork for broad VPP deployment.

By lowering the cost of DER financing for consumers and supporting VPP project deployment, LPO can mitigate barriers to adoption and catalyze faster and more equitable VPP adoption.

How LPO Can Help

LPO can finance a range of VPP-related projects that meet eligibility and programmatic requirements.

Projects may include, but are not limited to:

- Distributed Solar and Storage: Projects that manufacture or deploy distributed solar and storage systems with VPP software.

- Smart EV Charging Infrastructure: Projects that manufacture or deploy smart EV charging infrastructure.

- Energy-Efficient and Grid-Interactive Equipment: Projects that manufacture or deploy energy-efficient and grid-interactive equipment including heat pumps, electric water heaters, and HVAC systems.

- Other DERs and VPPs: Projects that manufacture or deploy other DERs and associated VPP software.

LPO Authorities That Can Support VPP-Related Projects

LPO can finance VPP-related projects through several avenues:

- Title 17 Clean Energy Financing Program – Innovative Energy and Innovative Supply Chain Projects (Section 1703): Financing for clean energy projects, including VPP projects, that use innovative technologies or processes not yet widely deployed within the United States. These projects must show a meaningful reduction of lifecycle greenhouse gases emissions or air pollutants, either via the process itself or via the end use of the material.

- Title 17 Clean Energy Financing Program – State Energy Financing Institution (SEFI) – Supported Projects (Section 1703): Financing for qualifying clean energy projects, including for VPP projects, that receive meaningful financial support from a SEFI. These projects do not have an innovation requirement.

- Title 17 Clean Energy Financing Program – Energy Infrastructure Reinvestment Projects (Section 1706): Financing for projects that retool, repower, repurpose, or replace energy infrastructure that has ceased operations or to enable operating energy infrastructure to avoid, reduce, utilize, or sequester air pollutants or anthropogenic emissions of greenhouse gases. This may include VPP projects that clearly replace services provided by retired or retiring energy infrastructure. These projects do not have an innovation requirement.

- Tribal Energy Financing Program: Financing available to federally recognized tribes and qualified tribal energy development organizations for energy development projects, including VPP projects. These projects do not have an innovation requirement.

VPPs are vital to the clean energy transition and achieving the nation’s climate goals. Let LPO partner with you to make your project a reality.

Next Steps

To learn more about how LPO could support your VPP-related project, please request a no-cost pre-application consultation. During the consultation, LPO will work with you to determine whether the project is eligible for financing.

To learn more about how DOE supports VPP-related projects across the research, development, demonstration, and deployment continuum, review the VPP Liftoff Report from DOE’s Pathways to Commercial Liftoff.

Contributors: Jennifer Downing

Michael Reed

Michael Reed is the Director of the Technical and Environmental Division (TED) for the Department of Energy’s Loan Programs Office (LPO). In this role, he provides technical management and performance monitoring of LPO’s $30 billion portfolio of clean energy projects. This portfolio includes projects in renewable energy and energy efficiency, advanced technology vehicle manufacturing, advanced fossil, nuclear, and related transmission infrastructure. Mr. Reed also oversees the technology evaluations of new applications submitted under open LPO solicitations.

Mr. Reed has over 30 years of diverse technical and leadership experience, serving as a senior executive and chief engineer in both the private and government sectors. Prior to joining LPO, Mr. Reed was the Chief Engineer of the U.S. Department of Energy’s Water Power Program, and the Vice President of Engineering for numerous defense and energy consulting companies. He has served in the U.S. Navy and the Naval Sea Systems Command, working on advanced power and propulsion systems.

Mr. Reed earned his BS in Engineering from the US Merchant Marine Academy, and an MS in Environmental Science and Policy from The Johns Hopkins University.