Over the last year, LPO has laid the groundwork to ensure the effective and efficient use of IRA funds. On the first anniversary of this historic legislation’s passage, we reflect on what we have accomplished and look ahead to the exciting work to come.

August 16, 2023On August 16, 2022, President Biden signed the Inflation Reduction Act (IRA) into law, which represented the most ambitious climate action in history and is catalyzing game-changing investments in clean energy in every pocket of the nation. The IRA is driving a clean energy renaissance; creating high-quality, union jobs for American workers; delivering healthier and safer communities; and reinforcing the United States’ role as a global leader in the industries of the future.

At the Loan Programs Office (LPO), the IRA expanded the types of projects eligible for financing and increased the office’s lending authority to support President Biden’s clean energy, environmental justice, job creation, and domestic manufacturing goals.

Over the last year, LPO has laid the groundwork to ensure the effective and efficient use of IRA funds. On the first anniversary of this historic legislation’s passage, we reflect on what we have accomplished and look ahead to the exciting work to come.

For the first time in over a decade, and as a result of the IRA, LPO’s three long-standing financing programs have undergone major changes.

IRA Year One SummaryAugust 2022-2023 | |||

| Title 17 Programs | ATVM | TELP | |

| Conditional Commitments Announced | Project Hestia | BlueOvalSK, KORE, CelLink, Li-Cycle, Redwood Materials, and Ioneer Rhyolite Ridge | - |

| Announcement Totals | up to $3 billion | up to $13.4 billion | - |

TITLE 17 CLEAN ENERGY FINANCING

New Opportunities, More Lending Authority, and Updated Guidance for the Title 17 Clean Energy Financing Program: IRA provided an additional $40 billion of loan authority for eligible section 1703 loan guarantees under Title 17 through September 30, 2026, and appropriated $3.6 billion in credit subsidy to support the cost of those loans.

The IRA expanded the Title 17 Clean Energy Financing Program to include financing for projects that reinvest in energy infrastructure (Energy Infrastructure Reinvestment [EIR], section 1706), and the legislation appropriated $5 billion through September 30, 2026, to carry out EIR, with a total cap on loans of up to $250 billion. IRA also funded an expansion to Title 17 that allows DOE to finance non-innovative projects that receive financial support or credit enhancements from State Energy Financing Institutions (SEFIs).

In the spring, LPO released updated Program Guidance for the Title 17 Clean Energy Financing Program reflecting these changes, informed by private sector and other stakeholder input. DOE also released a corresponding Interim Final Rule (IFR) for public comment. Since releasing the new Guidance and IFR, LPO has received applications for billions of dollars in financing for energy projects across the United States that would not have been eligible before the IRA. LPO recently outlined steps for how eligible state entities could become SEFIs.

In April, LPO announced a conditional commitment to Sunnova’s Project Hestia for an up to $3 billion partial loan guarantee, with many other applicants advancing through the pipeline. The IRA provided Title 17 with the additional loan authority to give eligible applicants confidence that LPO is open and ready for business.

ADVANCED TRANSPORTATION FINANCING

More Lending Authority for Advanced Technology Vehicles Manufacturing (ATVM) Loan Program and New Conditional Commitments Across the Domestic Supply Chain: IRA appropriated $3 billion for ATVM through September 30, 2028, to support credit subsidy of direct loans under ATVM, estimated to provide an additional ~$40 billion in loan authority, allowing LPO to finance more eligible projects. The IRA expanded the ATVM Loan Program to include projects that manufacture medium- and heavy-duty vehicles, maritime vessels, aviation, and other forms of transportation.

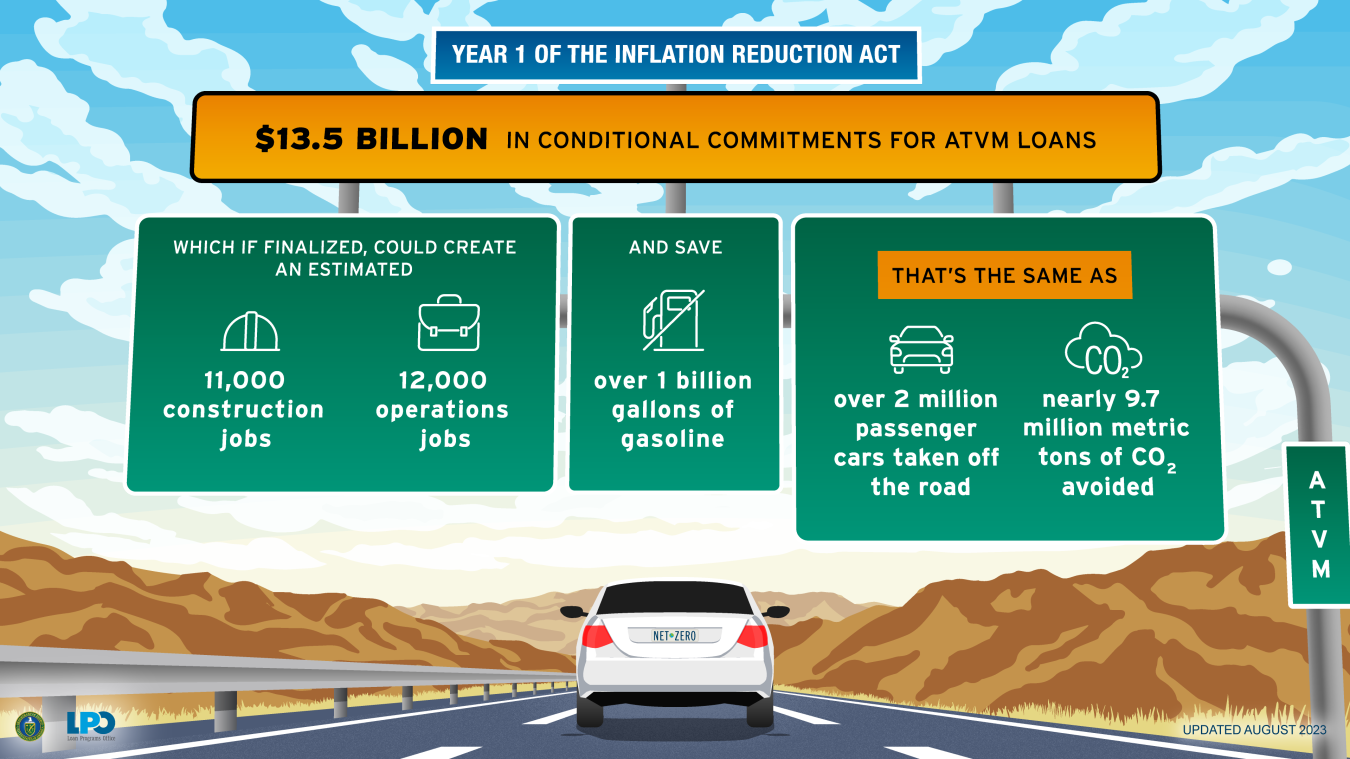

Since IRA’s passage, LPO has offered conditional commitments to BlueOvalSK, KORE, CelLink, Li-Cycle, Redwood Materials, and Ioneer Rhyolite Ridge. This nearly $13.5 billion in conditional commitments spans the electric vehicle and stationary storage supply chain and marks an important step toward onshoring and re-shoring manufacturing of the next generation of zero emissions vehicles, storage technologies, and critical materials production. If finalized, these projects will create tens of thousands of good-paying construction and operations jobs and displace an estimated 1.09 billion gallons of gasoline annually once fully operational.

TRIBAL ENERGY FINANCING

More Lending Authority for the Tribal Energy Finance Program: As a result of the IRA, LPO’s Tribal Energy Finance Program now includes $20 billion in lending authority. And Tribal entities may apply for direct loans through the U.S. Treasury’s Federal Financing Bank (FFB) via the Tribal Energy Loan Guarantee Program (TELGP) as authorized under The Consolidated Appropriations Act 2022, Public Law No. 117-103. TELGP was originally established to provide partial guarantees of commercial or other qualified loans made for energy development to a federally recognized Indian Tribe, Alaska Native Corporation, or Tribal energy development organization. While partial loan guarantees remain available, access to direct loans through FFB obviates the need for a Tribal borrower to also secure a commercial debt partner, which is expected to facilitate Tribes’ utilization of the program for energy development investments.

With expanded funding and authorities from the IRA, and a recently scaled up staff to continue attracting quality applications while effectively implementing and stewarding taxpayer resources, LPO is financing the next generation of clean energy infrastructure and advanced mobility manufacturing in the United States to ensure the benefits of the emerging clean energy economy benefit all Americans.

* This blog is a part of the Getting to Know LPO series, which provides more information about the role of the Loan Programs Office at the U.S. Department of Energy.

Jigar Shah

Former Director, Loan Programs Office

Jigar Shah served as Director of the Loan Programs Office (LPO) at the U.S. Department of Energy (DOE) from March 2021 to January 2025. He led and directed LPO’s loan authority to support deployment of innovative clean energy, advanced transportation, and Tribal energy projects in the United States. Prior, Shah was co-founder and President at Generate Capital, where he focused on helping entrepreneurs accelerate decarbonization solutions through the use of low-cost infrastructure-as-a service financing. Prior to Generate Capital, Shah founded SunEdison, a company that pioneered “pay as you save” solar financing. After SunEdison, Shah served as the founding CEO of the Carbon War Room, a global non-profit founded by Sir Richard Branson and Virgin Unite to help entrepreneurs address climate change.

Shah was also featured in TIME's list of the "100 Most Influential People" in 2024.

Originally from Illinois, Shah holds a B.S. from the University of Illinois-UC and an MBA from the University of Maryland College Park.