Identifying Regional Investment Clusters to Support Successful Project Delivery

Office of Manufacturing and Energy Supply Chains

January 17, 2025Introduction

The United States is experiencing a renaissance in domestic manufacturing. Since 2021, companies have announced $1 trillion in investments in the U.S. across a range of industries.1 These investments will help ensure the U.S. economy is positioned to be competitive in key sectors that will drive future growth, ranging from the advanced chips that will enable artificial intelligence and drive many critical defense technologies to the energy generation, storage, and transmission technologies that power the world. Beyond safeguarding economic and energy security, this historic investment in the real economy will create a new wave of opportunity for American workers and bring prosperity to their communities as high-quality manufacturing jobs come back to the U.S.

These investments have been catalyzed by the Bipartisan Infrastructure Law (BIL), the CHIPS and Science Act (CHIPS), and the Inflation Reduction Act (IRA). Collectively, this legislation authorized nearly $100 billion in grants and tax credits and roughly $400 billion in loans, resulting in a historic wave of government-enabled, private-sector led investment. The funding authorized by these bills is managed by a broad range of federal agencies. The Department of Energy’s Manufacturing and Energy Supply Chains Office (MESC) and the Department of Commerce’s Office of the Under Secretary of Economic Affairs (OUSEA) have aggregated and mapped major investments to better understand their regional impacts, and how those impacts may affect successful project deployment.

The current moment marks an inflection point where focus must shift from funding projects to delivering them. Ensuring that projects have the necessary resources and infrastructure to succeed will likely require proactive engagement across a broad range of stakeholders. Projects must secure permits to begin operations, hire workers with specialized skills to operate their facilities, and procure power—at times in enormous quantities—to run specialized equipment.

This analysis provides a structured approach to understanding the collective needs of projects and the underlying market conditions within the regional clusters where investments are taking place, to inform proactive engagement with public and private sector stakeholders to mitigate risks, and to thereby improve the likelihood that investments succeed and deliver real benefits for the communities in which they operate.

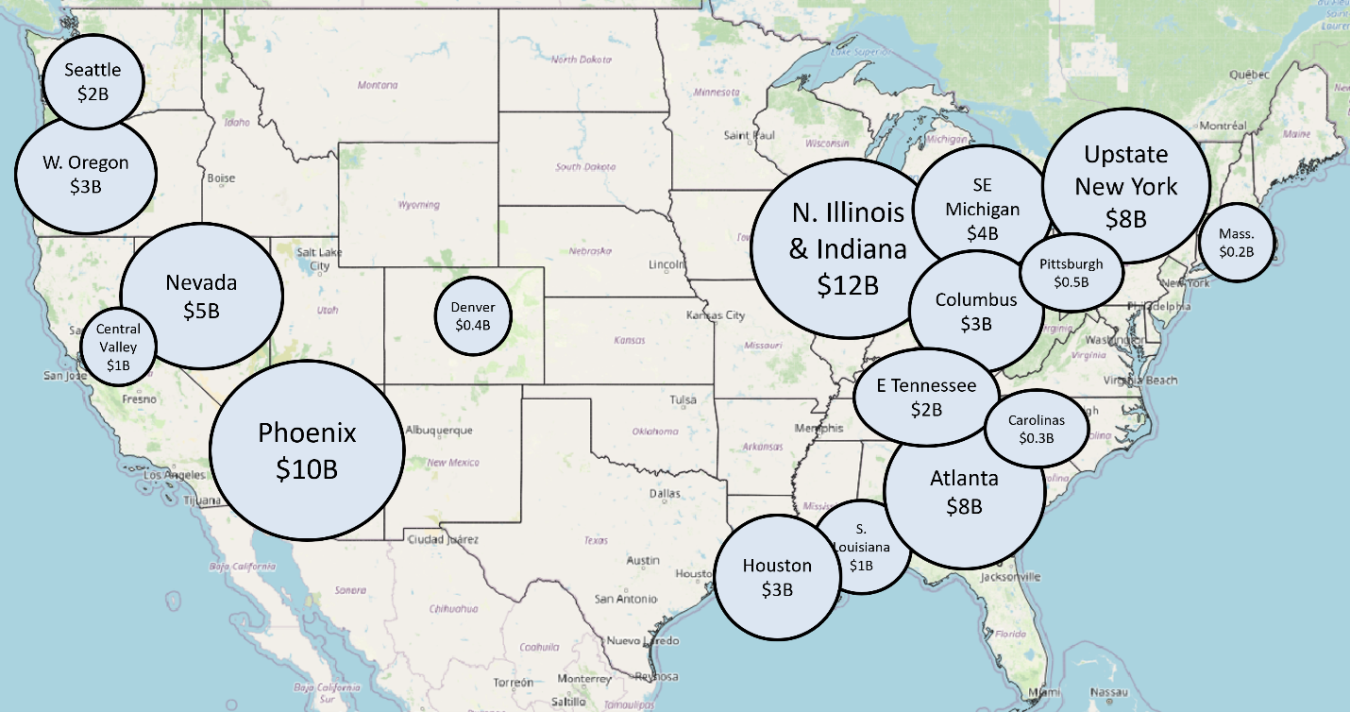

Identifying Regional Investment Clusters

To identify regional investment clusters, Department of Energy (DOE) and Department of Commerce (DOC) collected and mapped data on commercial scale infrastructure projects receiving funding from these two agencies. The analysis currently includes $89 billion in announced grants and tax credits and nearly $60 billion in loans and will be updated as new projects are announced. Investment clusters were identified as geographic regions with three or more major ($10M+) investments within a “commuter zone”, typically defined as an area with a radius of roughly 50 miles, or an identifiable state subregion (e.g., Upstate New York, California Central Valley). In a small number of instances, larger clusters were defined where projects with highly similar characteristics were spread over a broader geography, such as a series of mining and mineral processing projects in Nevada. Through this process, 17 major regional investment clusters were identified. Their locations, the scale of federal investment share, and a brief description of investment themes for each cluster are summarized below:

Major Investments Clusters with Federal Investment Totals

| Cluster Name | Federal Funding | Description |

| Northern Illinois and Indiana | $12B | A clean hydrogen hub, multiple projects to reduce GHG emissions in heavy industrial processes including through recycling, and battery component manufacturing. |

| Phoenix | $10B | Advanced semiconductor and chip manufacturing, as well as battery cell manufacturing. |

| Atlanta | $8B | Emerging hub for energy manufacturing, anchored by a solar manufacturing and recycling facilities and EV production. |

| Upstate New York | $8B | Major investments in chip manufacturing, with additional smaller investments in battery recycling and energy storage. |

| Nevada | $5B | Substantial investments in lithium and battery recycling; additional project to repurpose mine land for energy generation. |

| Southeast Michigan | $4B | Battery and automotive manufacturing, building on the region’s automaking legacy. |

| Houston | $3B | Industrial emissions reductions including multiple chemicals projects, carbon capture demonstrations, and a hydrogen hub, as well as investments in battery chemical and component manufacturing. |

| Western Oregon | $3B | Semiconductor and chip manufacturing, as well as a major hydrogen hub. |

| Eastern Tennessee | $3B | Major investments to build a robust battery manufacturing ecosystem, as well as manufacturing for energy supply chains. |

| Columbus | $3B | Chips production, hydrogen hub, and battery supply chain. |

| Seattle | $2B | Battery manufacturing and a major hydrogen hub. |

| Southern Louisiana | $1B | Offshore wind, chemicals for batteries and direct air capture). |

| Sacramento / Central Valley | $1B | Reducing industrial emissions, including a hydrogen hub, a direct-air-capture hub, and a long duration energy storage demonstration. |

| Pittsburgh | $0.5B | Energy manufacturing including utility-scale battery manufacturing and hydrogen supply chain. |

| Charlotte / W. Carolinas | $0.3B | Critical mineral processing and manufacturing for energy supply chains including grid equipment. |

| Massachusetts | $0.2B | Broad range of focus areas with multiple projects focused on hydrogen supply chain. |

It is important to note that the federal funding totals shown here account for only a fraction of total investment flowing into these regions. In the case of the Upstate New York cluster, a single $6.2 billion investment through the CHIPS program is supporting long-term plans for $100 billion in private investment in New York, which will create approximately 20,000 jobs.2 Additionally, while federal investment flowing into the Charlotte / Western Carolinas cluster totaled only $250M, the region as a whole attracted over $10B in private capital over the past year due to the region’s reputation as a hub for energy manufacturing.3 While significant federal funding is catalyzing investments in these regional clusters, the total economic impact from these and related investments can often be many times higher.

Maximizing Impact by Ensuring Success of Regional Investment Clusters

Such significant levels of investment into a geographic region introduces the possibility that local resources and infrastructure may face challenges to simultaneously meet the needs of multiple commercial-scale projects—including both projects that were the direct focus of federal investment, as well as indirect development that will support those projects.

Recognizing this challenge, the effort described in this initial analysis set out to assess the current state of labor and power markets within each of the regional clusters identified above, as well as the incremental demands—measured in terms of job and electricity demand growth—that federally funded projects may add to these geographic clusters. While this post does not provide detailed assessments for each cluster, the section below illustrates some of the labor and power market factors DOE and DOC consider in project delivery planning.

Labor Markets - For labor markets, several individual metrics were examined for each regional cluster using publicly available data through the Bureau of Labor Statistics, the American Community Survey performed by the Census, and the National Center for Education Statistics. Factors considered included population growth, wage growth, and unemployment rate to assess labor market tightness, as well as proxies for historical manufacturing activity, strength of the training pipeline, and cost of living to gauge how attractive a labor market may be to workers. The number of jobs being created by federally funded projects was also considered, in addition to the factors above, to provide an initial assessment of where labor markets may require additional support through workforce development investments to ensure a local talent pipeline exists to support this historic influx of capital.

Across the clusters analyzed, Upstate New York emerged as a regional cluster where early action may be particularly beneficial due to the combination of shrinking populations, preexisting wage growth above 4%, and a significant number of new—and in some cases specialized—jobs from new projects. The DOC’s Upstate New York Workforce Hub has been activated to respond to this challenge with various new workforce initiatives, including the state-funded “One Network for Advanced Manufacturing Partnerships” (ON-RAMP) program that will focus on providing industry-informed training; job placement services, including direct engagement with employers seeking talent; and holistic wraparound services designed to help participants overcome barriers to success such as childcare, transportation, stipends, financial counseling and education, etc.

Power Markets - For power markets, data from multiple power models from Lawrence Berkeley National Laboratory were leveraged alongside the National Transmission Needs Study published by the Department of Energy’s Grid Deployment Office. These resources provided data on power affordability, the state of the interconnect queue including clean energy mix, interconnect timelines, and both inter- and intra-regional transmission needs. Together, these metrics provided insight into the relative health of the grid within Independent System Operator (ISO) or Regional Transmission Operator (RTO) regions. Combining this background data with an assessment of project power needs within regional clusters enabled identification of areas where proactive grid planning may be beneficial to mitigate future congestion and ensure that projects can source the power they need to succeed.

This analysis surfaced that some clusters such as Southeast Michigan and Northern Illinois & Indiana are facing existing challenges with load growth and queue timelines, evidenced in part by interconnection timelines that exceed the U.S. grid system average. These challenges may become more entrenched as new projects requiring substantial amounts of power move from announcements to operations. In other regions, such as Upstate New York, the grid context is relatively more favorable but proactive planning may be worthwhile nevertheless due to the high power-intensity of chip manufacturing projects. Recognizing the importance of this challenge, the Department of Energy has created the Electricity Demand Growth Resource Hub to assist stakeholders with their planning.4

Developing a deep understanding of the context in which such a historic level of manufacturing and industrial investment is being made is a crucial step to ensure the conditions are present for these projects to succeed and to guide future actions.

The Path Ahead to Support American Manufacturing

The effort described above has provided important data on the scale of federal investments and the opportunities in the regional economic areas in which they focus, including data-driven assessments of key factors that will need to be managed to ensure project success. Proactively supporting project delivery will require continued and active coordination across federal agencies, across state and local government partners, and across relevant local stakeholders, from companies developing projects, to community groups and educational institutions, to utilities and grid operators. This type of localized engagement within regional investment clusters represents a new chapter in the American manufacturing renaissance, one in which projects are not simply conceived and planned but delivered.

The Department of Energy’s Office of Manufacturing and Energy Supply Chains looks forward to continuing to work across DOE, the Department of Commerce, other federal agencies, and stakeholders from across the regions represented in this analysis to work towards delivering the next generation of American manufacturing projects and to support the conditions necessary for their success.

Learn more about MESC’s mission to eliminate supply chain vulnerabilities and support the re-shoring, skilling, and scaling of U.S. manufacturing across energy supply chains.

1 White House (2024). “Investing in America.” https://www.whitehouse.gov/invest/

2 Department of Commerce. “Department of Commerce Awards CHIPS Incentives to Micron for Idaho and New York Projects and Announces Preliminary Memorandum of Terms for Virginia DRAM Project to Secure Domestic Supply of Legacy Memory Chips”, https://www.commerce.gov/news/press-releases/2024/12/department-commerce-awards-chips-incentives-micron-idaho-and-new-york; note: the jobs are slated to be created across New York and Idaho where an addition $25 billion in investment is planned.

3 Clean Investment Monitor. https://www.cleaninvestmentmonitor.org/

4 Department of Energy. “Electricity Demand Growth Resource Hub”, /electricitydemand