LPO Portfolio Performance Summary as of 12/31/24

Loan and Loan Guarantees Issued | $69.0 billion |

Conditional Commitments | $41.2 billion |

Amount Disbursed | $40.5 billion |

Principal Repaid | $15.2 billion |

Interest Paid* | $5.6 billion |

Actual and Estimated Losses | $1.03 billion |

Actual and Estimated Losses as % of Total Disbursement | 3.0% |

* Calculated without respect to Treasury's borrowing cost.

BUILDING A BRIDGE TO BANKABILITY

Through its Title 17 Clean Energy Financing Program and Advanced Technology Vehicles Manufacturing (ATVM) Loan Program, the Department of Energy’s Loan Programs Office (LPO) has financed a portfolio of innovative clean energy projects and advanced technology vehicle manufacturing facilities across the United States. LPO’s portfolio has supported job creation and is preventing harmful CO2 pollution while enhancing American competitiveness in the global economy.

Learn more about LPO's portfolio in the FY 2023 Annual Portfolio Status Report.

LPO PORTFOLIO AT A GLANCE

LPO currently manages a portfolio of loans, loan guarantees, and conditional commitments for projects that are under construction and in operations.

For information on individual projects within LPO’s portfolio, as well as projects that have exited the portfolio, please visit Portfolio Projects. As of 2023, these loans and loan guarantees have cumulatively resulted in more than $50 billion in total project investment.

LPO PORTFOLIO IMPACT

LPO’s Title 17 Clean Energy Financing Program requires that projects avoid, reduce, utilize, or sequester greenhouse gas or air pollutant emissions, while eligible vehicles under the ATVM Loan Program must demonstrate improved fuel economy.

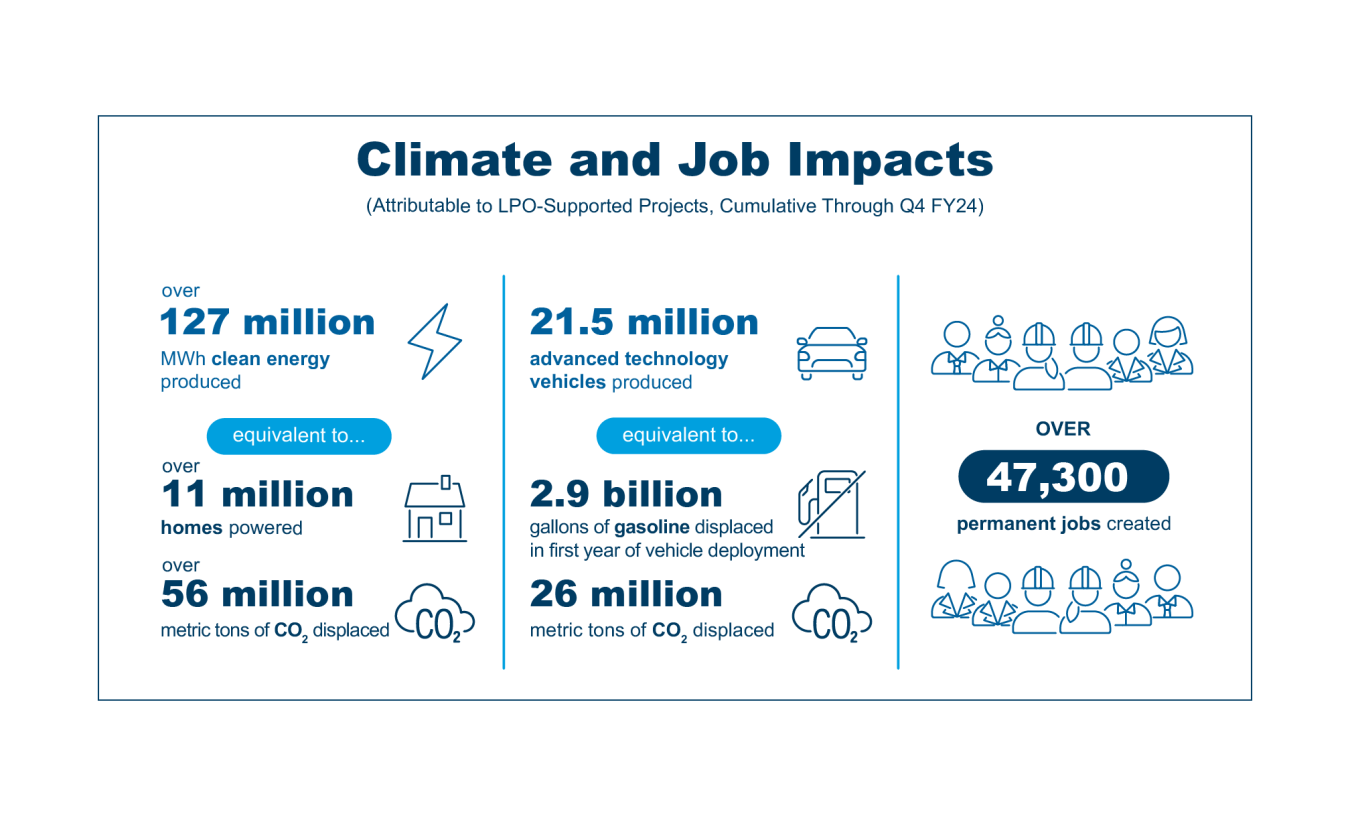

Throughout its history, LPO electricity generation projects have combined to generate over 127 million MWh cumulatively, which is equivalent to displacing over 56 million metric tonnes of CO2. Meanwhile, ATVM-supported projects have cumulatively displaced 2.9 billion gallons of gasoline (in first year of vehicle deployment), or the equivalent of 26 million metric tonnes of CO2.

In addition to catalyzing access to debt capital and reducing emissions, projects financed by LPO have been creating jobs. In total, these projects have created over 47,300 permanent jobs.

LPO PORTFOLIO MANAGEMENT

LPO’s Portfolio Management Division protects taxpayers interests by closely monitoring each project through construction, completion, and operation to ensure the terms and conditions of the loan documents are satisfied until the loan has been repaid in full. For more information, please visit the Portfolio Management page.

LPO PORTFOLIO PERFORMANCE

Although its mission, which includes financing innovative clean energy projects technologies, carries some degree of financial risk, LPO has maintained strong financial performance—even when compared with private financing of conventional energy projects in the United States. For each transaction, LPO’s team conducts rigorous due diligence that is comparable to, if not more stringent than, what is done in the private sector.

To learn more about how LPO is achieving its mission of accelerating the deployment of innovative clean energy projects and advanced technology vehicles manufacturing facilities, read the FY 2023 Annual Portfolio Status Report.