ON THIS PAGE

- EPAct 2005 Section 701 Statutory Requirements for Alternative Fuel Use in Dual-Fueled Vehicles

- EPAct 2005 Section 701 Applicability

- FEMP Resources and Best Practices

EPAct 2005 Section 701 Statutory Requirements for Alternative Fuel Use in Dual-Fueled Vehicles

Section 701 of the Energy Policy Act (EPAct) of 2005 (42 U.S.C. § 6374(a)(3)(E)), emphasis added, says:

(i) "Dual fueled vehicles acquired pursuant to this section shall be operated on alternative fuels unless the Secretary determines that an agency qualifies for a waiver of such requirement for vehicles operated by the agency in a particular geographic area in which—

(I) the alternative fuel otherwise required to be used in the vehicle is not reasonably available to retail purchasers of the fuel, as certified to the Secretary by the head of the agency; or

(II) the cost of the alternative fuel otherwise required to be used in the vehicle is unreasonably more expensive compared to gasoline, as certified to the Secretary by the head of the agency.

(ii) The Secretary shall monitor compliance with this subparagraph by all such fleets and shall report annually to Congress on the extent to which the requirements of this subparagraph are being achieved. The report shall include information on annual reductions achieved from the use of petroleum-based fuels and the problems, if any, encountered in acquiring alternative fuels."

EPAct 2005 Section 701 Applicability

See the Applicability page to determine which agencies are subject to the EPAct 2005 Section 701 requirements and which vehicles are specifically exempted.

FEMP Resources and Best Practices

Summary of Requirements

Section 701 of EPAct 2005 requires Federal agencies to use alternative fuel in dual-fueled vehicles when it is reasonably available and not unreasonably more expensive than gasoline. Generally, for the purpose of the Section 701 requirement, vehicles may qualify for a waiver by the U.S. Department of Energy (DOE) if:

- Alternative fuel is not reasonably available: "Not reasonably available" means that alternative fuel cannot be obtained within three miles (one way) from the vehicle's:

- Refueling location if displayed in FleetDASH, or

- Garaged location if the refueling location is not displayed in FleetDASH.

- Alternative fuel is unreasonably expensive: "Unreasonably expensive" means that the standard marketed price (as defined herein) for alternative fuel is more than gasoline at the same station. For the liquid fuels E85, LPG, and LNG, the marketed price is expressed in gallons. For CNG, the marketed price is GGEs. For electricity, the marketed price is GGEs adjusted for the electric vehicle efficiency factor (EVEF) because plug-in hybrid electric vehicles (PHEVs) operate more efficiently on electricity than gasoline. The EVEF allows the comparison of fuel quantities to more accurately reflect the percentage of miles a PHEV has driven on electricity. The EVEF is currently 2.75. It is determined by standards developed in the GREET Model and is subject to future updates. Updates to the EVEF will be posted on FAST FAQ: Fuel Conversion Factors.

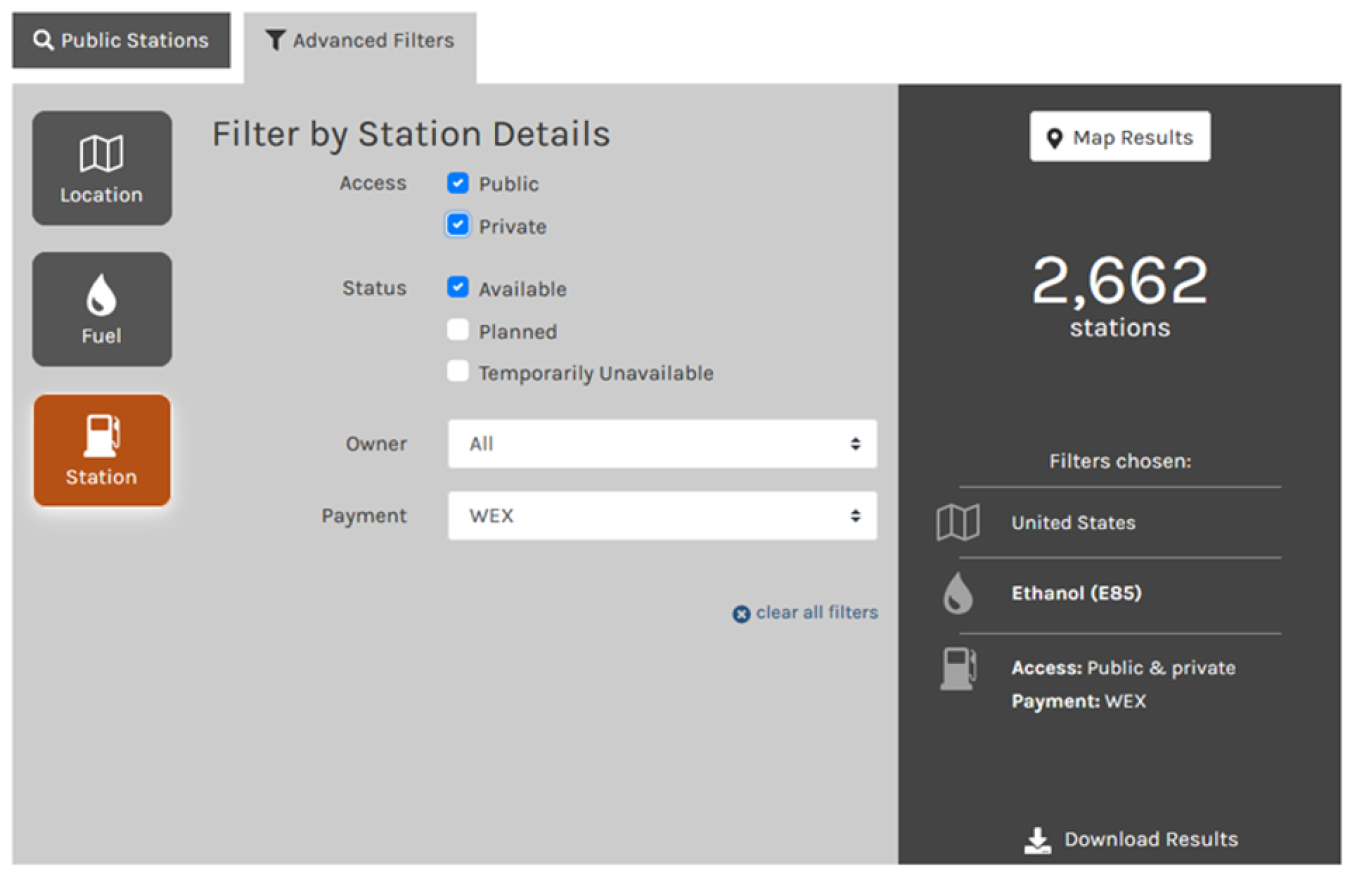

Fleets can use the Alternative Fuel Data Center (AFDC) Station Locator to find fuel in their area or along a route that they are traveling. The Station Locator can be filtered to include specific fuels, private stations by owner type, and payment types accepted. Select "Advanced Filters," filter the details appropriately, and click "Map Results" to view the data in the tool or "Download Results" to view the results in a .csv file format that can be opened in Excel as shown in the figure below.

Advanced Filter in AFDC Station Locator

- Alternative fuel is not reasonably available: "Not reasonably available" means that alternative fuel cannot be obtained within three miles (one way) from the vehicle's:

Section 701 of EPAct 2005 requires Federal agencies to use alternative fuel in dual-fueled vehicles when it is reasonably available and not unreasonably more expensive than gasoline. Since 2007, Federal agencies have requested waivers for vehicles from the EPAct Section 701 requirements as part of a June data call for the subsequent FY. The U.S. Department of Energy (DOE) has reviewed those waiver requests and granted or denied them prior to the subsequent FY. At the end of each FY, DOE has reviewed each Federal agency's covered alternative fuel use and compared it to total fuel use in non-waivered vehicles to determine compliance.

There are two different processes through which DOE will begin evaluating waiver requests for fiscal year (FY) 2021 (beginning with the FY 2020 data call):

- Automated reporting in Fleet Sustainability Dashboard (FleetDASH): For vehicles with fueling transaction data in FleetDASH, agencies may note in their FAST submissions that they request waivers be processed through FleetDASH. In this case, fuel purchase transactions are automatically evaluated for proximity to alternative fuel, starting at the beginning of FY 2021. As described below, the new process combines and automates the waiver and compliance calculations for vehicles loaded into FleetDASH.

- Waiver requests in FAST: For individual vehicles not captured in FleetDASH, agencies may request waivers based on garage location in FAST. For these vehicles, agencies note in their end-of-year reporting (starting in FY 2020) whether they believe dual-fueled vehicles should receive waivers from the alternative-fuel-use requirements (for FY 2021 and subsequent years) in lieu of a separate Section 701 data call.

What Is a Dual-Fueled Vehicle?

All dual-fueled vehicles in covered Federal agencies are subject to this requirement except those specifically exempted. This includes light-duty vehicles (LDVs), medium-duty vehicles (MDVs), and heavy-duty vehicles (HDVs), regardless of whether they are agency-owned, commercially leased, or leased from the U.S. General Services Administration (GSA). Additionally, government-owned, contractor-operated vehicles are considered government motor vehicles and are therefore subject to these requirements, consistent with existing reporting requirements in FAST. (See GSA's Federal Management Regulation § 102-34.215.)

A dual-fueled vehicle is defined as "a dual fueled automobile, as such term is defined in section 32901(a)([9]) of title 49" or "a motor vehicle, other than an automobile, that is capable of operating on alternative fuel and is capable of operating on gasoline or diesel fuel." 42 U.S.C. § 6374(g)(5). This includes E85 flex fuel vehicles (FFVs), bi-fuel LPG vehicles, bi-fuel natural gas vehicles, and PHEVs. DOE does not consider diesel vehicles capable of operating on biodiesel, including renewable diesel (designated as B20, B100, or R100), to be dual-fueled vehicles for Section 701 compliance purposes nor alternative fuel vehicles (AFVs) for the EPAct 1992 AFV acquisition requirements. Instead, biodiesel fuel use in Federal fleets is assessed separately as bonus credit for EPAct 1992 AFV acquisitions. See 42 U.S.C. §§ 13212(b)(1)(D) and 13220. The table below lists all dual-fueled vehicle fuel configurations that agencies can report in FAST.

| Dual-Fueled Vehicle Fuel Configurations |

|---|

| Vehicle Type |

| E85 FFVs |

| CNG bi-fuel vehicles |

| LNG bi-fuel vehicles |

| LPG or propane bi-fuel vehicles |

| PHEVs |

Evaluating Compliance

DOE determines compliance using two methods, which are discussed in more detail below.

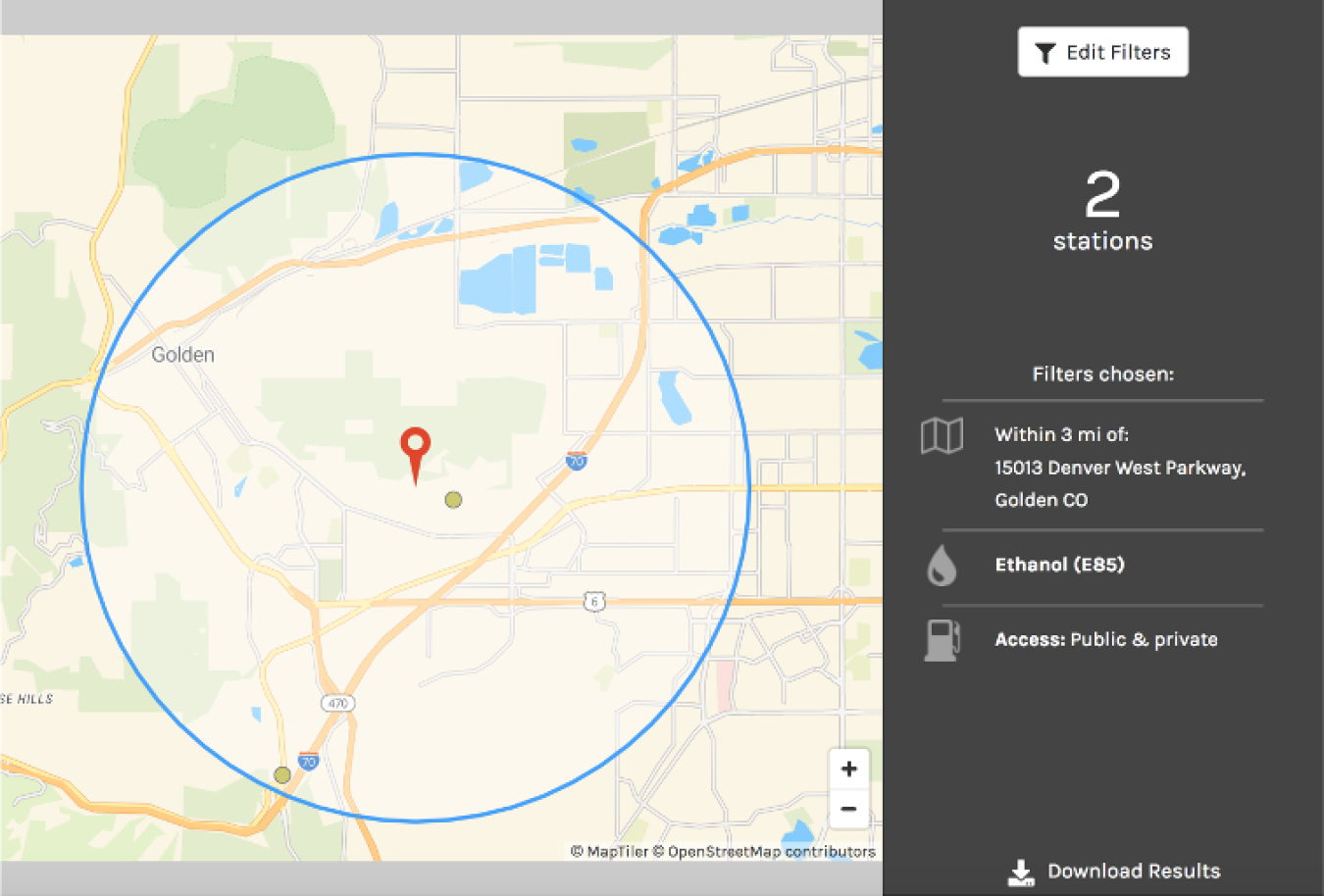

- Automated waivers in FleetDASH (preferred): FleetDASH measures fuel availability each time that the vehicle is fueled based on whether alternative fuel is available within three miles of each fuel purchase transaction. Since vehicles can operate well beyond the immediate vicinity of their reported garage location, the transaction location provides a much more accurate measure of whether alternative fuel is "reasonably available" in the geographic area in which the vehicle is operated. Therefore, this is the preferred method to assess compliance with EPAct 2005 Section 701.

- Annual waiver requests in FAST: Only for those vehicles with fueling transactions not captured in FleetDASH, agencies can request an EPAct 2005 Section 701 waiver through FAST for the entire FY. Each vehicle must be reported during the year-end Federal fleet reporting of ALD in FAST with an attribute identifying how the agency believes the vehicle should be treated with respect to Section 701 for the following FY.

FleetDASH Automated Waivers and Compliance

DOE uses FleetDASH to assess compliance on the fuel transaction level. If a dual-fueled vehicle is operating in an area where alternative fuel is available at a reasonable cost, the vehicle must use the alternative fuel instead of gasoline or diesel.

FleetDASH compares the location of fueling transactions for dual-fueled vehicles with alternative fuel stations listed in the AFDC Station Locator. The Station Locator includes public stations as well as private stations owned by Federal agencies, local governments, and private companies. FleetDASH can designate those stations as available or unavailable to a given agency or to the Federal government more generally. Users can flag stations as available or unavailable in order to improve the accuracy of this designation. In addition, users can flag stations in FleetDASH as unreasonably more expensive than gasoline for two-month periods as described below.

FleetDASH Comparison of Fueling Transaction and Nearby Alternative Fuel Stations

The compliance assessment in FleetDASH waives a fueling transaction from the requirement to use alternative fuel if the transaction does not occur within three miles of an available alternative fuel station. Distance is measured as a straight line between the actual fueling transaction and the alternative fuel station (i.e., as the crow flies). Driving time is not considered. Stations will be designated as unavailable in any of the three following situations.

- The station does not allow access to a particular agency or agencies or to the Federal government more generally: FleetDASH users may flag a particular station as inaccessible. After the user notes an issue accessing a particular station, DOE confirms whether the station owner does not support fueling Federal vehicles at all or only supports fueling of vehicles for certain agencies or fleets. Users may send supporting documentation including images to the National Renewable Energy Laboratory (NREL) Federal Fleet Project Leader. If the station does not sell fuel to any Federal vehicles, then that station is considered unavailable to all agencies. If the station owner clarifies that the station is available to some agencies but not others, it is considered available only to those agencies. For an example of the latter situation, a co-located U.S. Army and U.S. Air Force base may have a station that dispenses fuel to both agencies on base or to all U.S. Department of Defense agencies, but the fuel might not be available to civilian agencies.

- The station does not accept the fueling card used by an agency: Stations that do not accept the fueling card used by an agency will be designated as unavailable to that agency. For example, if U.S. Postal Service (USPS) uses only the Voyager credit card and a given station does not accept Voyager, that station will be designated as unavailable to USPS.

- Unreasonably expensive fueling stations: Stations can be flagged in FleetDASH as temporarily unavailable. FleetDASH users can flag a single transaction at a station if the alternative fuel costs are unreasonably expensive. DOE classifies unreasonable expense based on how the fuel is marketed so that drivers can make purchase decisions based on posted prices.

- Liquid fuels (E85, LPG, and LNG) are commonly sold by the gallon. Led by E85, liquid fuels comprised 100% of price-based waiver requests and 99% of all waiver requests overall in FY 2019. E85, LPG, and LNG are considered unreasonably expensive if the fuel costs more on a per-gallon basis than gasoline because they have less energy than gasoline on a per gallon basis. If the alternative fuel costs more on a per-gallon basis than gasoline in addition to having less energy than gasoline, then it is considered unreasonably expensive. Given the relative ease for fleets to rely on posted per-gallon prices, DOE relies on per-gallon costs to define whether a cost is reasonable for liquid fuels.

- CNG is a gaseous fuel often sold in units of GGEs and since 2000 has consistently been less expensive than gasoline on a GGE basis. Therefore, DOE determines the price reasonableness of CNG based on whether the fuel is less expensive than gasoline on a GGE basis.

- Electricity is generally sold by the kWh, and vehicles driven by electric motors use energy much more efficiently than vehicles driven by internal combustion engines. Therefore, when comparing a PHEV’s quantity of electricity used to the PHEV’s quantity of petroleum used, the electricity use—measured in GGEs—is multiplied by the EVEF. The EVEF allows the comparison of fuel quantities that more accurately reflect the percentage of miles a PHEV has driven on electricity. The EVEF is currently 2.75. It is determined by standards developed in the GREET Model and is subject to future updates. Updates to the EVEF will be posted on FAST FAQ: Fuel Conversion Factors.

DOE verifies the accuracy of unreasonably expensive flags by contacting the station owner. If the price is confirmed as unreasonably expensive, DOE considers that station to be unavailable for all Federal fleet vehicles for two months. During the month that the high fuel cost is noted and the following month, that high-cost station is excluded from compliance for the entire Federal government (i.e., no Federal vehicles are required to fuel there).

- Unreasonably expensive fueling stations: Stations can be flagged in FleetDASH as temporarily unavailable. FleetDASH users can flag a single transaction at a station if the alternative fuel costs are unreasonably expensive. DOE classifies unreasonable expense based on how the fuel is marketed so that drivers can make purchase decisions based on posted prices.

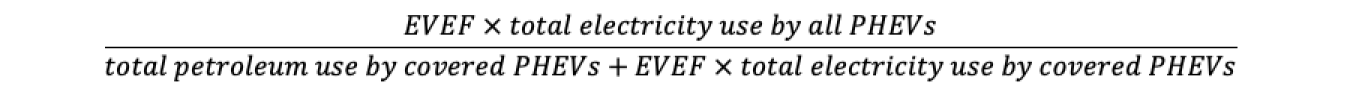

All covered PHEVs are considered non-waivered dual-fueled vehicles for Section 701 compliance. Accounting for the EVEF, electricity is consistently less expensive than gasoline. Furthermore, because PHEVs are assumed to be charged at the garage location, there is no requirement to check for available electricity infrastructure near the transaction location. DOE uses the following formula to calculate Section 701 compliance for PHEVs:

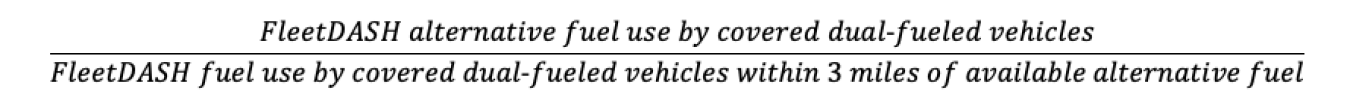

Compliance for FleetDASH vehicles is measured on an annual basis at the fleet and agency levels. Compliance is calculated by dividing the amount of alternative fuel used in covered dual-fueled vehicles by the total quantity of fuel consumed by those vehicles within three miles of available alternative fuel stations. Below is the formula for assessing compliance for dual-fueled vehicles in FleetDASH except for PHEVs:

Agencies can view performance in FleetDASH over any month in the past year at the vehicle level for the percentage of time that drivers used alternative fuel in that vehicle when it was available within three miles. They can then use that information to alter driver behavior and increase refueling with alternative fuel. If electricity charging is not captured for a particular PHEV in FleetDASH, the dashboard will note that performance cannot be calculated for that vehicle; DOE completes the annual compliance calculations for such vehicles using electricity consumption reported in FAST.

FAST Waivers and Compliance

Agencies are encouraged to include their vehicles in FleetDASH for Section 701 compliance when possible. FleetDASH automates the waiver process and applies station accessibility and unreasonable cost flags across the entire Federal government—which can save agencies significant amounts of time—and it more accurately measures where vehicles are operating for the determination of compliance by using fuel transaction locations instead of garage locations. Nevertheless, DOE FEMP continues to support Section 701 waivers and compliance determinations in FAST for the remaining vehicles not included in FleetDASH.

If part or all of an agency's fleet is not present in FleetDASH, then DOE follows a process using FAST data submissions. During the annual fleet FAST data call, an agency may request waivers based on a lack of available (and not unreasonably expensive) alternative fuel stations near their vehicle garage locations for the coming FY.

DOE reviews those requests and determines whether fuel is reasonably available or unreasonably more expensive than gasoline and assigns a waiver status to each vehicle (i.e., "Waiver Granted," "No Waiver," "Exempt"). At the end of the FY, DOE assesses Section 701 compliance by calculating the percentage of alternative fuel out of total fuel use in non-waivered dual-fueled vehicles. Agencies can only request waivers in FAST for vehicles with fueling transactions not captured in FleetDASH. FleetDASH is more accurate and less time-intensive on the agency’s part. Generally, waivers are requested at the end of one year for the coming year (e.g., FY 2021 waivers are requested through the FY 2020 data call). For vehicles reported at the end of the FY without waiver requests from the prior year’s report (such as new vehicle acquisitions), DOE applies the prospective year waiver status to the prior year. For example, if an agency acquires a new vehicle in FY 2021, the fleet manager would not have reported the vehicle in FY 2020 and therefore not have requested a waiver for FY 2021. In this example, when the agency reports the vehicle at the end of 2021 with the appropriate waiver request status, DOE determines whether a waiver for that vehicle is merited at that time and applies that waiver status to the vehicle request as the FY 2021 waiver status for that vehicle as well.

For agencies to qualify for full-year waivers, they must show that fuel is not reasonably available within three miles from the relevant vehicle’s garage location. Driving time is not assessed.

Before submitting waiver requests in FAST, agencies must identify what portion of their fleet is not present in FleetDASH. Agencies can confirm what segments of their fleet are present in FleetDASH with the NREL Federal Fleet Project Leader. If fleet vehicles are not in FleetDASH, agencies can work with NREL to add these vehicles to FleetDASH which will streamline Section 701 reporting in future years and improve identification of missed fueling opportunities.

Then, agencies should identify single-fuel vehicles or those designated as foreign, law enforcement (LE), emergency response, or any other exemption status listed in the table in the Applicability section. These vehicles are exempt from Section 701 requirements and may be marked "Exempt."

For the remaining vehicles, agencies should use the AFDC Station Locator to determine the availability of the appropriate alternative fuel or contact the Defense Logistics Agency. If no fuel is available for purchase within three miles of the vehicle garage location or if the fuel is consistently too expensive, fleet managers should submit waiver requests in FAST. For leased vehicles, GSA Fleet provides an annual list of dual-fuel vehicles that may qualify for waivers based on their reported garage location. Contact the GSA Fleet's Alternative Fuel Vehicle Team for more information.

To streamline reporting for Federal fleet managers, DOE has aligned the remaining Section 701 waiver request/review process with year-end Federal fleet reporting of ALD in FAST. Each vehicle must be reported with an attribute identifying how the agency believes the vehicle should be treated with respect to Section 701. Beginning with the FY 2020 data call, FAST will support designations for the following:

- FleetDASH: Vehicle is present in FleetDASH and the agency selects FleetDASH as the sole basis for determining the waiver standing of the vehicle with respect to Section 701, as well as the vehicle's compliance to the extent applicable with that requirement.

- Exempt: Vehicle is not subject to Section 701 requirements based on any combination of:

- The owning/operating agency's designation as EPAct-exempt (see the Applicability page for details)

- The vehicle being located in an area considered foreign for FAST reporting

- The vehicle's fuel type/configuration not being subject to Section 701's alternative fuel consumption requirement (i.e., it is not a dual-fueled vehicle)

- The vehicle's status as exempt.

- No Waiver: Vehicle is subject to Section 701 requirements and does not require a waiver

- Waiver Requested—Distance: Alternative fuel is not available within a three-mile radius of the garage location

- Waiver Requested—No Access: Nearby fuel station(s) does not provide access to agency drivers (additional documentation required)

- Waiver Requested—Fuel Card: Nearby fuel station(s) does not accept fuel payments using agency fuel card

- Waiver Requested—Cost: Alternative fuel is unreasonably more expensive at nearby fuel station(s) than gasoline (additional documentation required).

The designations "Exempt," "No Waiver," and the "Waiver Requested" variations should only be used by agencies for vehicles not tracked in FleetDASH. DOE may analyze non-exempt vehicles that are present in the FleetDASH data set using FleetDASH even if miscategorized by agencies.

Waivers based on distance or driving time may not be requested for covered vehicles designated as "location withheld" in FAST. FAST will validate that each vehicle's Section 701 designation is consistent with the vehicle's other reported attributes (e.g., foreign vehicles and vehicles in non-EPAct-covered agencies cannot be designated as "No Waiver" or with one of the "Waiver Requested" variations).

- For vehicles reported to FAST without the corresponding Section 701 designation (i.e., the designation is omitted), FAST provides a default value based on other reported vehicle attributes.

- Any such vehicles in non-EPAct-covered agencies, foreign vehicles, LE vehicles, emergency response vehicles, and vehicles with fuel type/configurations not subject to Section 701 will be treated as if they were reported with the "Exempt" designation described above.

- All other such vehicles are treated as if they are reported with the "No Waiver" designation described above.

Agency fleet managers should review the relevant entries in the FAST data element and business rules reference documents for additional details on the reporting and validation of this vehicle attribute.

Agency fleet managers may review waiver determinations from the prior year in FAST prior to submitting waiver requests for the coming year. This information can be used to inform waiver requests for the coming year, although availability and costs of alternative fueling stations may change.

In all cases where additional documentation is required, that documentation should be emailed to the DOE Federal Fleet Program Manager and the NREL Federal Fleet Project Leader. All documentation must list the vehicle identifiers used in FAST in order to correlate the documentation to the waiver request. Documentation may include images and should include the following information as well:

- Denied access documentation should include the email exchange with the station owner denying access or the phone number and name for the station owner if the conversation took place by phone.

- Unreasonable expense documentation should include the fuel price for gasoline and the fuel price per gallon for the alternative fuel on a weekly basis over five consecutive weeks in the preceding year. DOE uses the same criteria for determining unreasonable expense in FAST as FleetDASH for the various fuels as described above.

DOE imports waiver determinations into FAST and notifies agencies as quickly as possible following agency data submissions. DOE may designate Section 701 waiver requests as granted ("Waiver Granted"), denied ("No Waiver"), exempt from the requirements on other grounds such as LE or emergency response ("Exempt"), or FleetDASH-covered ("FleetDASH") in FAST. Waiver requests for vehicles in FleetDASH are automatically reviewed in FleetDASH and not in FAST. DOE grants waivers if any of the waiver reasons described above are confirmed as accurate. If documentation is required but not provided, waivers are denied automatically.

Agencies may appeal DOE waiver decisions within 30 days of notification. Appeals listing the vehicle identifier used in FAST and accompanying documentation should be emailed to the DOE Federal Fleet Program Manager and the NREL Federal Fleet Project Leader.

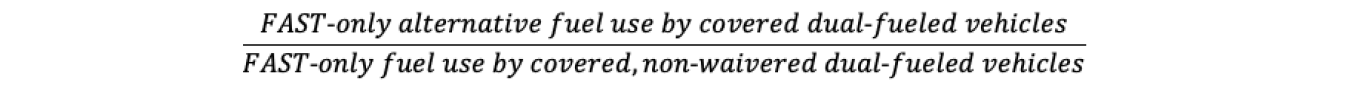

After each FY ends, DOE assesses Section 701 compliance for vehicles in FAST. Vehicles that do not receive a waiver in FAST (and which are not captured in FleetDASH) are designated as having reasonable access to alternative fuel 100% of the time. DOE assesses Section 701 compliance using the percentage of alternative fuel compared to total fuel use in non-waivered dual-fueled vehicles (calculated by dividing the amount of alternative fuel used in covered dual-fueled vehicles by the total amount of fuel consumed in covered, non-waivered dual-fueled vehicles). This gives agencies bonus credit for fuel used by waivered dual-fueled vehicles that still use alternative fuel where available. Below is the formula for assessing compliance for dual-fueled vehicles found only in FAST except for PHEVs:

Similar to FleetDASH, FAST compliance determinations are made using GGEs for all vehicles except that PHEV electricity use is multiplied by the EVEF.

Agency-Wide Compliance

Because an agency may have some vehicles in FleetDASH and others in FAST, DOE combines the results from both systems into a single compliance percentage for each agency. DOE divides the number of GGEs used in dual-fueled vehicles by the total applicable fuel consumption, which is the number of GGEs consumed by covered, dual-fueled vehicles in non-waivered transactions (i.e., transactions within three miles of available fuel for vehicles in FleetDASH and all transactions for non-waivered vehicles found only in FAST). In both FAST and FleetDASH, electricity consumption in PHEVs includes the EVEF, as described above, to account for electric motor efficiency.