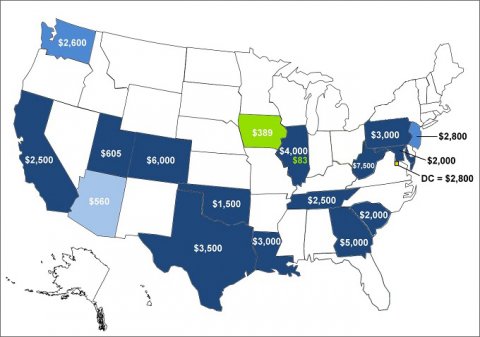

In addition to a federal government tax credit up to $7,500, consumers who purchase plug-in electric vehicles (PEVs) may also receive state government incentives which are different for each state. Shown below are state incentives that can be quantified, such as tax credits and rebates, sales and use tax exemptions, reduced license taxes, title tax exemptions, and reduced registration fees. West Virginia and Colorado have the highest incentive amounts, both of which are tax credits.

Select State PEV Incentives Totals by State, July 2013

Supporting Information

| State | Tax Credits & Rebates | Sales and Use Tax Exemption | Reduced License Tax | Title Tax Exemption | Reduced Registration Fee | Total |

|---|---|---|---|---|---|---|

| AZ | $560 | $560 | ||||

| CA | $2,500 | $2,500 | ||||

| CO | $6,000 | $6,000 | ||||

| DC | $2,800 | $2,800 | ||||

| GA | $5,000 | $5,000 | ||||

| IA | $389 | $389 | ||||

| IL | $4,000 | $83 | $4,083 | |||

| LA | $3,000 | $3,000 | ||||

| MD | $2,000 | $2,000 | ||||

| NJ | $2,800 | $2,800 | ||||

| OK | $1,500 | $1,500 | ||||

| PA | $3,000 | $3,000 | ||||

| SC | $2,000 | $2,000 | ||||

| TN | $2,500 | $2,500 | ||||

| TX | $3,500 | $3,500 | ||||

| UT | $605 | $605 | ||||

| WA | $2,600 | $2,600 | ||||

| WV | $7,500 | $7,500 | ||||

Notes:

Sources: Alternative Fuels Data Center accessed July 2, 2013. | ||||||