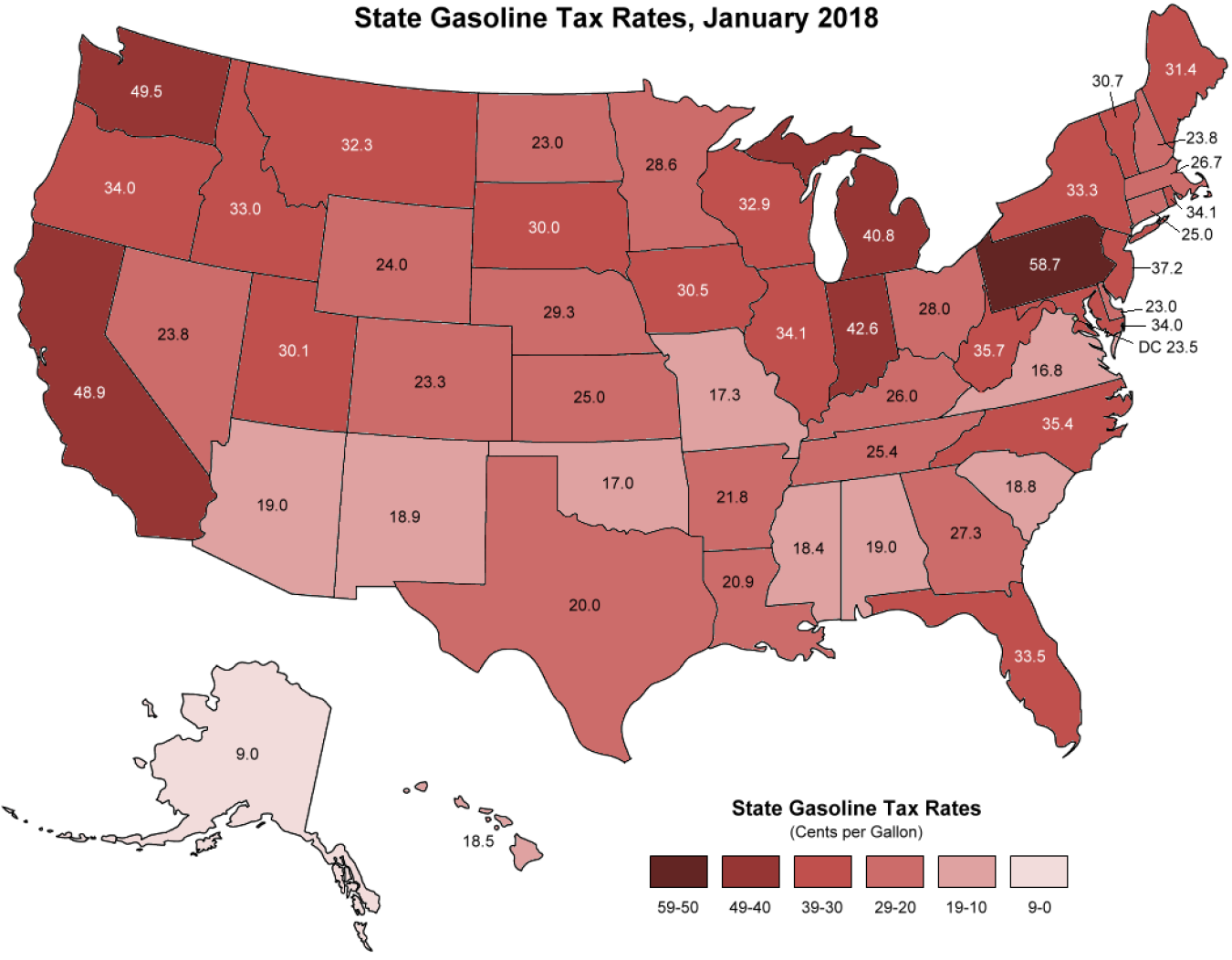

In addition to the 18.4 cents per gallon federal gasoline tax, the states also tax gasoline at varying rates.

June 25, 2018In addition to the 18.4 cents per gallon federal gasoline tax, the states also tax gasoline at varying rates. Some states have sales and/or use taxes added to gasoline excise taxes while others have inspection fees, environmental fees, leaking underground storage tank taxes, etc. The Energy Information Administration has compiled gasoline excise taxes, along with other state taxes and fees, to arrive at an estimate of the amount of state taxes consumers are paying per gallon. According to these estimates, Pennsylvania currently has the highest per gallon tax rate for gasoline; the Pennsylvania rate includes the Oil Company Franchise Tax, a variable rate tax adjusted annually, and the Underground Storage Tank Indemnification Fund fee. Alaska, with a 9-cent gasoline tax rate, has by far the lowest gasoline tax rate of any state.

Note: Includes gasoline tax plus other per gallon fees, such as leaking underground storage tank fees. See source for additional specifics on individual state rates.

Source: Energy Information Administration, Petroleum Supply Monthly, Federal and state motor fuels taxes, accessed May 16, 2018.