Disclaimer: This U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) resource provides an overview of the federal investment and production tax credits. It does not constitute professional tax advice or other professional financial guidance and may change based on additional guidance from the Treasury Department. See the Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics for information for individuals and the Federal Solar Tax Credit for Businesses for information for businesses.

Overview

Manufacturers are eligible for two federal tax credits that support clean energy manufacturing in the United States: the Advanced Manufacturing Production Tax Credit (45X MPTC) and the Advanced Energy Project Investment Tax Credit (48C ITC). The 45X MPTC provides tax credits for each clean energy component domestically produced, while the 48C ITC provides a tax credit for purchasing and commissioning property to build an industrial or manufacturing facility.

The 45X MPTC was established and the 48C ITC was expanded, as part of the Inflation Reduction Act of 2022.

Projects cannot claim both the 45X MPTC and 48C ITC—if components were made at a facility that claimed a 48C ITC, manufacturers cannot also claim the 45X MPTC.

Which Tax Credit Should I Choose?

The 48C ITC is an upfront tax credit based on the capital investment in an industrial (e.g., recycling) or manufacturing facility and does not vary by how much product a plant sells, while the 45X MPTC is earned over time based on the production and sale of specific, eligible components. Whether to choose the ITC or the MPTC depends foremost on whether the facility will be manufacturing MPTC-eligible components (as the ITC eligibility is broader). If eligible for both, the decision depends on the comparative significance of capital cost versus operating cost for the facility.

In general, manufacturing facilities that produce components eligible for the 45X MPTC receive more value from the 45X MPTC than the 48C ITC (as long as they can place their manufacturing plants online before the 45X credits are scheduled to sunset).

Advanced Manufacturing Production Tax Credit (45X MPTC)

The 45X MPTC is a per-unit tax credit for each clean energy component domestically produced and sold by a manufacturer.[1] The 45X MPTC is claimed on federal corporate income taxes.[2]

The credit varies by eligible component and is multiplied by the number of units produced by the taxpayer that were sold that year. The table below summarizes the eligible solar components, their definitions, and the unit credit amount.

What Qualifies for the 45X MPTC?

Clean energy components that qualify for the 45X MPTC include the PV module and some of its subcomponents, inverters, tracking system components, batteries, and certain critical minerals. Components that are produced at a facility that received a 48C ITC after August 2022 are not eligible.

Summary of Eligible Components for Advanced Manufacturing Production Tax Credit

PV Module and Subcomponents

| Eligible Components | Definition | Credit Amount |

|---|---|---|

| Solar-grade polysilicon | Silicon that is suitable for photovoltaic manufacturing and is purified to a minimum purity of 99.999999 percent silicon by mass. | $3 per kilogram (kg) |

| PV wafer | A thin slice, sheet, or layer of semiconductor material of at least 240 square centimeters that comprises the substrate or absorber layer of one or more photovoltaic cells. Produced by a single manufacturer either i) directly from molten or evaporated solar grade polysilicon or deposition of solar grade thin film semiconductor photon absorber layer, or ii) through formation of an ingot from molten polysilicon and subsequent slicing. For purposes of the 45X credit, ingot and wafer manufacturing are considered part of single production process (per the IRS's October 2024 final rules). Therefore, if wafers are produced from ingots made at a facility that received a 48C allocation, the wafers would be ineligible to receive 45X credits. | $12 per square meter (m2) |

| PV cell (crystalline or thin-film) | The smallest semiconductor element of a solar module that performs the immediate conversion of light into electricity. | 4¢ per watt-direct current (Wdc) |

| Polymeric backsheet | A sheet on the back of a solar module that acts as an electric insulator and protects the inner components of such module from the surrounding environment. | 40¢ per m2 |

| PV Module | The connection and lamination of photovoltaic cells into an environmentally protected final assembly that is suitable to generate electricity when exposed to sunlight, and ready for installation without an additional manufacturing process. | 7¢ per Wdc |

PV Inverter

| Eligible Components | Definition | Credit Amount |

|---|---|---|

| Central inverter | Suitable for large utility-scale systems. >1 megawatt-alternating current (MWac) | 0.25¢ per watt-alternating current (Wac) |

| Utility inverter | Suitable for commercial or utility-scale systems. ≥125 kWac, ≤1 MWac, with a rated output ≥600 volt three-phase power. | 1.5¢ per Wac |

| Commercial inverter | Suitable for commercial or utility-scale applications. ≥20kWac, ≤125 kWac with a rated output of 208, 480, 600, or 800 volt three-phase power >600 volt three-phase power. | 2¢ per Wac |

| Residential inverter | Suitable for a residence. ≤20 kWac, with a rated output of 120 or 240 volt single-phase power. | 6.5¢ per Wac |

| Microinverter | Suitable to connect with one solar module. ≤650 Wac with a rated output of i) 120 or 240 volt single-phase power, or ii) 208 or 480 volt three-phase power. For purposes of the 45X credit, a direct current optimized inverter system (DC optimized inverter system) may qualify as a microinverter (per the IRS's October 2024 final rules). | 11¢ per Wac |

PV Tracking Systems

| Eligible Components | Definition | Credit Amount |

|---|---|---|

| Torque tube | A structural steel support element (including longitudinal purlins) that is part of a solar tracker, is of any cross-sectional shape, may be assembled from individually manufactured segments, spans longitudinally between foundation posts, supports solar panels and is connected to a mounting attachment for solar panels (with or without separate module interface rails), and is rotated by means of a drive system. | 87¢ per kg |

| Structural fasteners | A component that is used to connect the mechanical and drive system components of a solar tracker to the foundation of such solar tracker, to connect torque tubes to drive assemblies, or to connect segments of torque tubes to one another. | $2.28 per kg |

Batteries

| Eligible Components | Definition | Credit Amount |

|---|---|---|

| Electrode active materials | Cathode materials, anode materials, anode foils, and electrochemically active materials, including solvents, additives, and electrolyte salts that contribute to the electrochemical processes necessary for energy storage. | 10% of the costs incurred by the taxpayer due to production of such materials |

| Battery cells | An electrochemical cell comprised of 1 or more positive electrodes and 1 or more negative electrodes, with an energy density of not less than 100 watt-hours per liter, and capable of storing at least 12 watt-hours of energy. The capacity of the cell to the maximum discharge amount of the cell or module (capacity-to-power ratio) cannot exceed 100:1. | $35 per kilowatt-hour (kWh) |

| Battery module | A module, in the case of a module using battery cells, with 2 or more battery cells that are configured electrically, in series or parallel, to create voltage or current, as appropriate, to a specified end use, or with no battery cells, and with an aggregate capacity of not less than 7 kilowatt-hours (or, in the case of a module for a hydrogen fuel cell vehicle, not less than 1 kilowatt-hour). The capacity of the module to the maximum discharge amount of the cell or module (capacity-to-power ratio) cannot exceed 100:1. | $10 (or, in the case of a battery module that does not use battery cells, $45) per kWh |

Critical Minerals

| Eligible Components | Definition | Credit Amount |

|---|---|---|

| Critical minerals | In addition to products and components, the mining of certain critical minerals are included. Those most likely to pertain to the solar PV supply chain include: Aluminum that is purified to 99.9% or converted from bauxite to at least 99% purity; graphite that is purified to a minimum purity of 99.9%; tellurium that is purified to at least 99% purity or converted to cadmium telluride; indium that is purified to at least 99 percent, converted to indium tin oxide, or converted to indium oxide of at least 99.9% purity; gallium that is purified to 99% purity; arsenic that is purified to 99% purity; titanium that is purified to 99% purity. | 10% of the costs incurred by the taxpayer due to production of such minerals |

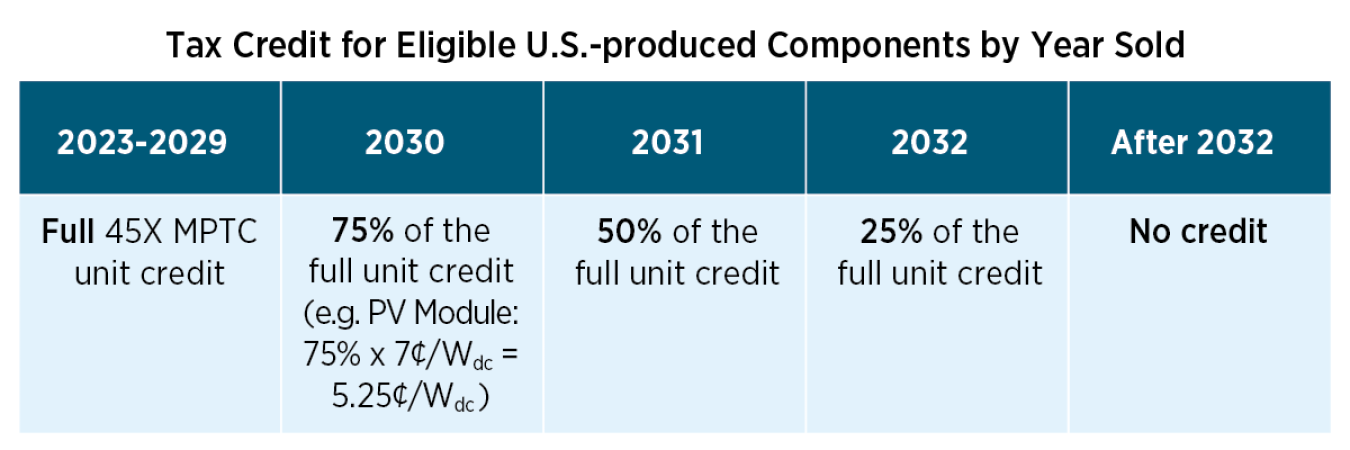

When do the Tax Credits Phase Out?

The phaseout does not apply to the production of critical minerals, which continue indefinitely.

Manufacturers can also monetize the tax credit through a direct payment from the Internal Revenue Service (IRS) in lieu of a credit against their taxes due, or opt to transfer the credit, as described below:

Direct pay option

Manufacturers can receive a refund for 45X MPTC tax credits for the first five years they are claimed, though are still subject to the 2033 credit sunset. The five-year limitation does not apply if the manufacturer is a tax-exempt organization (i.e. non-profit), state, municipality, the Tennessee Valley Authority, Indian Tribal government, any Alaskan Native Corporation, or any rural electric cooperative. Partnerships, including S corporations, are allowed to claim direct pay for 45X MPTC.[3]

Organizations that wish to receive direct pay must pre-register with the IRS before the tax return is due and receive a registration number.[4] More information about the electronic pre-filing registration process can be found on the IRS website. Registration is required every year for each applicable property; however, pre-registration does not confirm eligibility.

A penalty of 20% may apply where excess payments occur.[5] For more information on direct pay, please see IRS’s final guidance.

Transfer of credit

Manufacturers may also elect to transfer all, or a portion, of the tax credits for a given year to an unrelated eligible taxpayer. Credits from a single property can be sold to multiple buyers in the same tax year.

Organizations that wish to transfer their tax credits must pre-register with the IRS before the tax return is due and receive a registration number.[6] More information about the electronic pre-filing registration process can be found on the IRS website. Registration is required every year for each applicable property, i.e., for every year of the PTC, however pre-registration does not confirm eligibility. The registration number must be provided on the tax return of both the seller and the buyer of the tax credits. If the credits from a single property have multiple buyers, the same registration is used.

Payments for the credit, which are not required to be the same dollar value of the credit, must be made in cash and are not considered a taxable event (i.e., no taxes are owed on receiving the payment and no deduction is possible for making the payment, however may not include any other non-cash, or non-cash equivalent, such as a payment in-kind). The buyer and seller must together complete a transfer election statement covering the details of the transfer, which is submitted by both the seller and the buyer with their tax returns.

A penalty of 20% may apply where excess credits occur.[7] Transfer credits are ineligible for direct pay. For more information, please see IRS’s final guidance on transferability.

For further information on the 45X MPTC credit, please see IRS's final guidance.

Advanced Energy Project Credit (48C ITC)

Overview

The 48C ITC is a U.S. Department of Treasury program that awards tax credits for investing in various eligible property:

- designed to produce or recycle advanced energy components, such as solar modules, inverters, and batteries

- re-equip industrial or manufacturing facilities with equipment designed to reduce greenhouse gas emissions by at least 20 percent through the installation of low- or zero-carbon process heat systems (among other things)

- re-equip, expand, or establish an industrial facility for the processing, refining, or recycling of critical materials[8]

The credit can be claimed on federal corporate income taxes and represents a percentage of eligible investment costs placed in service during the tax year.

Starting in 2023, awardees are eligible for an ITC of 30% of qualifying investment if they satisfy the labor requirements issued by the Treasury Department for any labor associated with re-equipping, expansion, or establishment of the manufacturing facility.[9] Projects that do not meet the labor requirements are only eligible for a 6% tax credit. These labor requirements do not apply to operating the facilities after they have been placed into service.

Manufacturers must apply to receive the grant at such time and containing such information as Treasury may require. The program began accepting concept papers on May 31, 2023, for a first round of $4 billion in credits, with approximately $1.6 billion reserved for projects in energy communities. Final decisions were made on March 29, 2024. Several companies that received the 48C grant in the first round of allocations voluntarily chose to self-disclose their name and project information to the DOE.

The program began accepting concept papers on May 22, 2024 for a second round of $6 billion in credits, with approximately $2.5 billion set aside for projects in energy communities. Concept papers were due June 21, 2024. Final decisions will be made no later than January 15, 2025.

Once an applicant is allocated a credit by Treasury, it has two years from the date of allocation to provide evidence, such as permits, that the requirements have been met, after which Treasury will provide certification for the credit. Within 2 years of receiving certification, the applicant must place the project in service and notify Treasury; the location cannot be materially different from the location specified in the application. Projects may not be placed in service prior to allocation. Treasury will make the awardees and the credit amounts public after projects meet certain project readiness criteria required for certification.

Availability of Credits

- The 48C program was first initiated under the American Recovery and Reinvestment Act (ARRA) of 2009 to support investments in projects that establish, expand or re-equip clean energy manufacturing facilities that produce solar, storage, and electric grid equipment systems and components (other types of clean energy manufacturing facilities are also eligible for the 48C ITC but are beyond the scope of this guidance).

- Originally funded at $2.3 billion, tax credits were made available to 183 domestic clean energy manufacturing facilities during Phase I of the program in January, 2010. Phase II was launched in 2013 to utilize $150 million in tax credits that were not used by awardees from the first round.[10]

- The Inflation Reduction Act of 2022 was enacted in August 2022, expanding the types of qualified investments,[11] and allowing for $10 billion in new 48C tax credits to be allocated to projects in 2023 or later. At least $4 billion of the credits (40%) must be allocated to projects located in census tracts that are designated in the Act as an ”energy community” and that have not been allocated a 48C credit before the enactment of the Inflation Reduction Act.

- Denial of double benefits: projects will lose their ability to claim the 45X MPTC on components made at a facility that has received the 48C ITC after enactment of the Inflation Reduction Act.[12]

Selection Criterion

Applications are evaluated based on the following four technical review criteria, as described in guidance provided by the IRS on May 31, 2023:

- Commercial viability – including consideration of the shortest project timeline, lowest levelized cost of energy, and consideration of risk mitigation strategies.

- Net impact on greenhouse gas reduction – including direct, indirect, and lifecycle emissions.

- Ability to strengthen U.S. supply chains – Round 2 priority areas for the solar supply chain are: polysilicon, wafer, ingot/wafer production tools, and solar glass production.

- Workforce and community engagement – a plan for this must be included in the application.

Projects will also be ranked based on program policy factors such as portfolio diversity (size, technology, geography, etc.).

Direct Pay and Transfer of Credit

- Direct pay option: Manufacturers can receive a refund for 48C ITC tax credits only if they are a tax-exempt organization (i.e., non-profit), state, municipality, the Tennessee Valley Authority, Indian Tribal government, any Alaskan Native Corporation, or any rural electric cooperative. See Federal Solar Tax Credits for Businesses for an in-depth discussion of Direct Pay options for tax-exempt organizations. A penalty of 20% may apply where excess payments occurred.[13] Additional restrictions apply for facilities located in the U.S. territories.[14]

- Transfer of credit: Manufacturers may also elect to transfer all, or a portion, of the tax credits for a given year to an unrelated eligible taxpayer. See Federal Solar Tax Credits for Businesses for an in-depth discussion of Transfer of Credit options for tax-exempt organizations. Payments for the credit must be made in cash and are not considered a taxable event (i.e. no taxes are owed on receiving the payment and no deduction is possible for making the payment). A penalty of 20% may apply where excess credit occurred.[15]

Advanced Manufacturing Investment Credit (48D)

Overview

The Advanced Manufacturing Investment Credit (48D), part of the CHIPS and Sciences Act of 2022, provides a tax credit for facilities that make semiconductors or the equipment used to produce them—including solar wafers, as was clarified in October 2024.

The tax credit is equal to 25% of the qualified investment in an advanced manufacturing facility. Qualified investments are tangible property integral to the operation of an advanced manufacturing facility that are placed in service after December 31, 2022. Construction on the planned eligible property must begin before January 1, 2027.

This credit can be claimed on federal corporate income taxes or can come in the form of a direct payment from the IRS as described below but cannot be transferred. 48D can be taken in addition to the 48C or 45X credits.

Direct Pay

Taxpayers, including partnerships and S corporations, can receive a refund from the IRS for tax credits on qualified investments placed in service after 2022. Organizations that wish to receive direct pay, also known as elective pay, must pre-register with the IRS before the tax return is due and receive a registration number.

- More information about the electronic pre-filing registration process is available on the IRS website. Additional information on elective pay can be found in the IRS’s final guidance. 48D tax credits may not be transferred.

More Information

Ask Questions

Internal Revenue Service (IRS), 1111 Constitution Avenue, N.W., Washington, D.C. 20224, (800) 829-1040.

Find Resources

- Find more information on the federal statutes regarding the ITC and MPTC at www.govinfo.gov.

- SETO held a webinar on September 27, 2022, to discuss the recent policy changes in the Inflation Reduction Act. Watch the recording, download the slides, and read the Q&A.

- View SETO's other federal solar tax credit resources.

- Download a PDF version of this webpage: Federal Tax Credits for Solar Manufacturers

Endnotes

[1] Product must be sold to an unrelated party, i.e., those who are not treated as a single employer under the regulations prescribed under section 52(b), or that are integrated, incorporated, or assembled into another eligible component that is sold to an unrelated party. https://www.irs.gov/newsroom/faqs-regarding-the-aggregation-rules-under-section-448c2-that-apply-to-the-section-163j-small-business-exemption.

[2] 26 U.S.C. § 45X.

[3] See https://www.irs.gov/credits-deductions/elective-pay-and-transferability-frequently-asked-questions-elective-pay Q12 for a discussion of what ownership structures are allowed.

[4] See https://www.irs.gov/credits-deductions/elective-pay-and-transferability-frequently-asked-questions-elective-pay Q18 for a list of steps for receiving a direct payment.

[5] H.R.5376 – Inflation Reduction Act of 2022, Section 6417. Taxpayers may elect to stop receiving direct payments in subsequent years, however, once stopped, they cannot go back to direct payments.

[6] See: https://www.irs.gov/credits-deductions/elective-pay-and-transferability-frequently-asked-questions-transferability Q4 for a list of steps for transferring tax credits.

[7] H.R.5376 – Inflation Reduction Act of 2022, Section 6418. The transferee cannot further transfer any credits it received in the transfer.

[8] § 7002(a) of the Energy Act of 2020 (30 U.S.C. § 1606(a))

[9] The prevailing wage requirement states that all wages any laborers and mechanics employed by the taxpayer or any contractor or subcontractor in the re-equipping, expansion, or establishment of a manufacturing facility must be paid at a rate not less than prevailing rates of that locality as determined by the Secretary of Labor. The apprenticeship requirement states that a certain percentage of the total construction labor hours for a project must be performed by an apprentice. The percentage increases over time, starting at 10% for projects beginning construction in 2022, 12.5% for projects beginning construction in 2023, and 15% for projects beginning construction after 2023. Projects can correct the prevailing wage requirements if they were originally not satisfied, by paying the affected employees the difference in wages plus interest, and paying the Secretary of Labor $5,000 for each impacted individual. The apprenticeship requirements also can be satisfied if a good faith effort was made to comply or if a penalty is paid to the Secretary of Treasury in the amount of $50/ hour of non-compliance. Both penalties increase if the requirements are intentionally disregarded. For more information see Section 13101(f) of the Inflation Reduction Act of 2022.

[10] /downloads/fact-sheet-48c-manufacturing-tax-credits.

[11] The Inflation Reduction Act of 2022 expanded eligible manufacturing facilities to include (but not limited to) investments made to produce energy storage systems and components, grid modernization equipment or components, and electrolyzers run on renewable electricity.

[12] Project investments are also ineligible for the 48C credit if they were claimed for the 48B (qualifying gasification project), 48E (clean electricity investment), 45Q (carbon sequestration credit), or 45V (clean hydrogen) credit.

[13] H.R.5376 – Inflation Reduction Act of 2022, Section 6417. Taxpayers may elect to stop receiving direct payments in subsequent years, however, once stopped, they cannot go back to direct payments.

[14] The IRS has previously ruled that the ITC can be claimed by U.S. corporations, citizens, or partnerships that own solar in U.S. territories; however, companies and individuals are not eligible to receive the tax benefits if they do not pay federal income tax, which means most Puerto Ricans and Puerto Rican companies are ineligible. Therefore, solar assets in U.S. territories would most likely need to be owned by outside U.S. investors to take advantage of the ITC (Farrell, Mac, Lindsay Cherry, Jeffrey Lepley, Astha Ummat, and Giovanni Pagan. 2018. Reimagining Grid Solutions: A Better Way Forward for Puerto Rico. Even if electing direct pay (Publication 5817-B (Rev. 4-2024) (irs.gov)).

[15] H.R.5376 – Inflation Reduction Act of 2022, Section 6418. The transferee cannot further transfer any credits it received in the transfer.