In 2020, with $1.2 million in funding from DOE's Solar Energy Technologies Office (SETO), the Carsey School of Public Policy partnered with the Inclusiv Center for Resiliency and Clean Energy to develop the Solar and Green Lending Professional Training.

Solar Energy Technologies Office

December 7, 2023

When most people think of financing, they think of a traditional commercial bank or credit union that provides mortgages, lines of credit, loans, and investments—not necessarily solar or community solar projects. But across the United States, there are approximately 10,000 mission-driven, community-based lenders serving low-income and underrepresented communities who’re working to expand access to clean energy in these areas through climate financing.

These lending institutions typically help community members buy their first home, purchase a car, and obtain better financial footing. They also finance healthcare clinics, charter schools, houses of worship, and other small businesses that improve the lives of community members. In recent years, community-based lenders have turned their focus to climate financing to offer these communities the chance to enter the clean energy transition. And for the past three years, these lending institutions have had the option to receive formal training in climate financing.

The University of New Hampshire is one organization that recognizes the need for clean energy finance training for lending professionals. In 2020, with $1.2 million in funding from the U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO), its Carsey School of Public Policy partnered with the Inclusiv Center for Resiliency and Clean Energy to develop the Solar and Green Lending Professional Training.

The Solar and Green Lending Professional Training is an 8-week, instructor-led, virtual program open to community-based lending institutions. Lending professionals learn to develop new solar and green lending products, collaborate with partners to provide solar and green financing, and deploy new loans or investments. Once lenders complete the program, the alumni network provides them with ongoing support including regular workshops, a peer sharing site, and tangible tools including guidebooks, sample loan policies, and workbooks. Interested lenders are invited to learn more and apply.

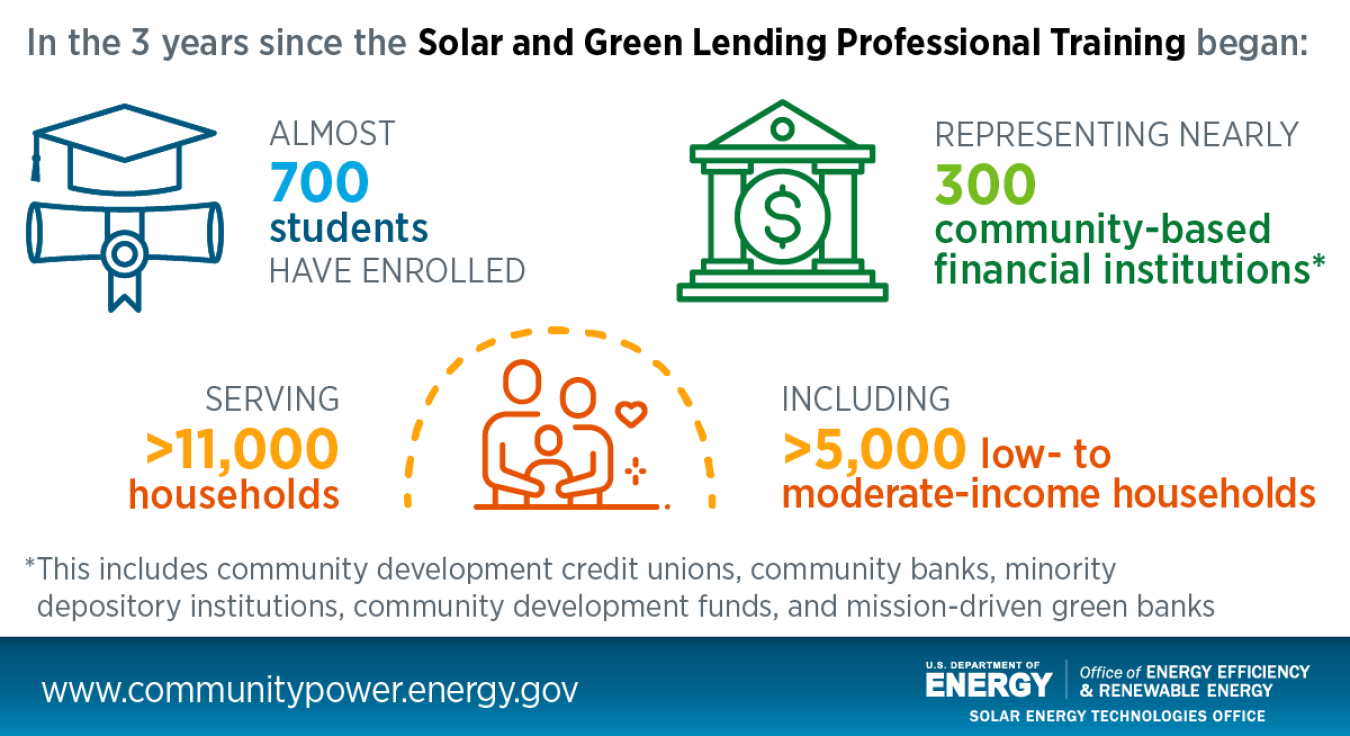

In the three years since the program’s inception, almost 700 students have enrolled, representing nearly 300 community-based financial institutions (community development credit unions, community banks, minority depository institutions, community development funds, and mission-driven green banks), serving more than 11,000 households, including over 5,000 low- and moderate-income households. These students are able to take the knowledge learned throughout the course and create real-world financial products to serve those in their communities.

Organizations who took the course also shared that it’s helped immensely in learning more about their markets and the benefits of solar energy. In the next several years, the program aims to add a formal technical assistance component to its offering to further support lending institutions as they launch their products. This training also has the potential to help lending institutions get ready to deploy Greenhouse Gas Reduction Fund funding from the U.S. Environmental Protection Agency.

The training program’s success inspired SETO’s Community Power Accelerator Learning Lab, which provides training on community solar project development and business models for developers, nonprofits, cooperatives, and other organizations looking to integrate meaningful benefits (defined as equitable access and consumer protections; meaningful households savings; resilience and grid benefits; community –led economic development; and solar workforce) into their portfolios. It includes a short, self-paced 101 course as well as a more intensive, seven-week course on the community solar development process. SETO’s Learning Lab is administered by the Center for Impact Finance at the University of New Hampshire’s Carsey School of Public Policy in partnership with the National Community Solar Partnership and is available at no cost to participants. Interested organizations are encouraged to apply.

DOE’s Solar Energy Technologies Office is also working to expand equitable access to solar energy in underserved communities through initiatives like the Community Power Accelerator Prize, and Sunny Awards for Equitable Community Solar, which award funding to organizations whose projects increase access to community solar across the United States.

Learn more about the National Community Solar Partnership, the Community Power Accelerator, and SETO’s research on equitable access to solar energy.