Section 179D of the Internal Revenue Code (hereafter referred to as 179D) provides federal tax deductions for placing in service (installing) eligible energy efficient property in commercial buildings. 179D has been amended by the Inflation Reduction Act (Public Law. 117-169) for taxable years beginning after Dec. 31, 2022.

Energy efficient property, referred to as "property," installed as part of the following building systems may be eligible for this deduction: interior lighting; heating, ventilating, and air conditioning (HVAC); hot water (service water heating); and/or building envelope. This applies to property placed in service as part of a new construction or a building upgrade project. Other energy efficient processes or equipment loads are not eligible.

The tax deduction amount ($/ft2) increases with greater improvements in energy efficiency. The deduction amount also increases five-fold if the project meets certain prevailing wage and registered apprenticeship (PWA) requirements. For more information, please refer to the IRS rule on PWA requirements.

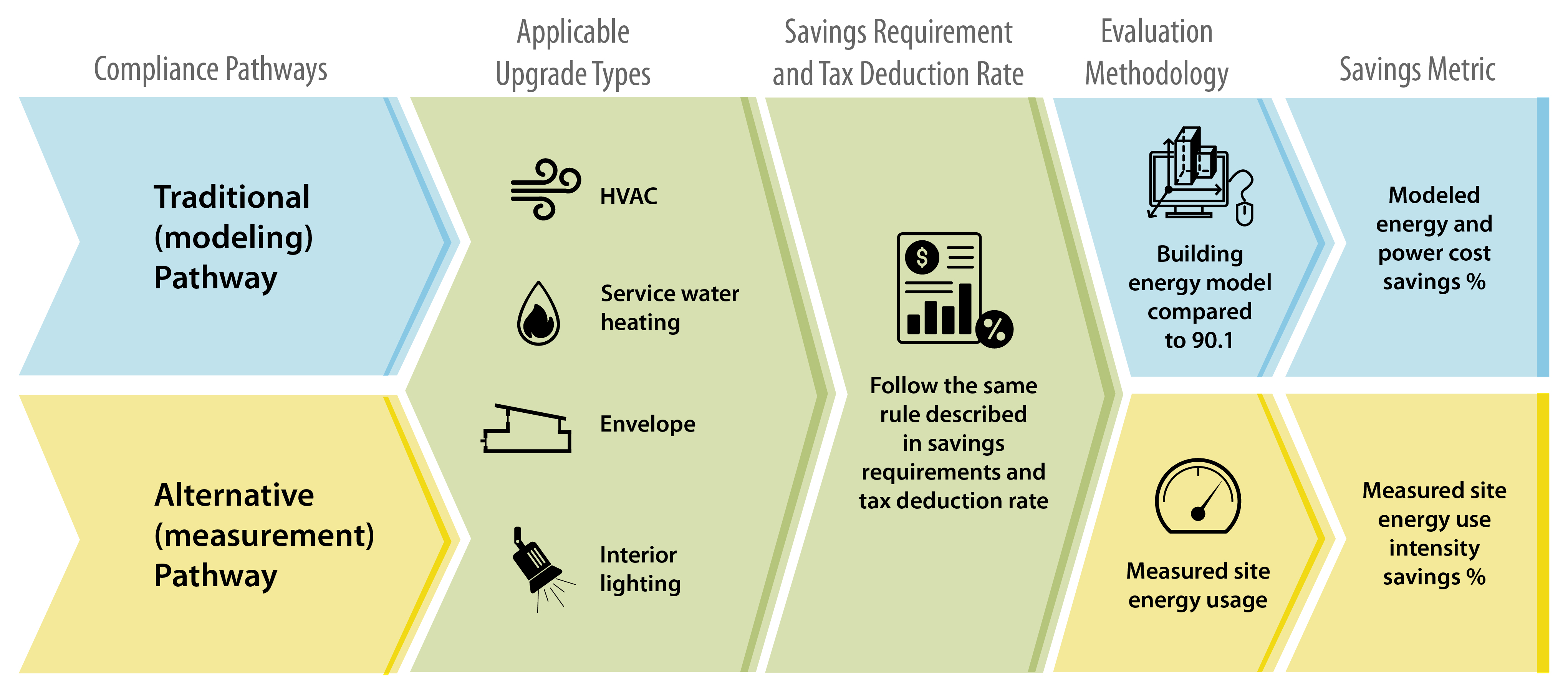

There are two pathways to pursue a 179D tax deduction:

- The Traditional (Modeling) Pathway, sometimes referred to as the deduction for energy efficient commercial building property (EECBP), which is applicable to both new construction and building upgrade projects.

- The Alternative (Measurement) Pathway, sometimes referred to as the deduction for energy efficient building retrofit property (EEBRP), which is applicable for upgrades to buildings placed in service at least 5 years before the outset of the upgrade project.

Certain tax-exempt entities are also now eligible to allocate their deduction. Please refer to additional information below.

All information on energy.gov is applicable to projects claiming deductions beginning with taxable year 2023. For previous taxable years, please see the IRS page Amount of the deduction for 2022 and before. Taxpayers should only rely on the version of the statute applicable to the taxable year at issue, and to the applicable IRS notices. This information is not meant to be a substitute for professional guidance or the statute itself; please consult a tax professional and refer to the Section 179D statute.

How Much Tax Deduction Is Available Through the Alternative and Traditional Pathways?

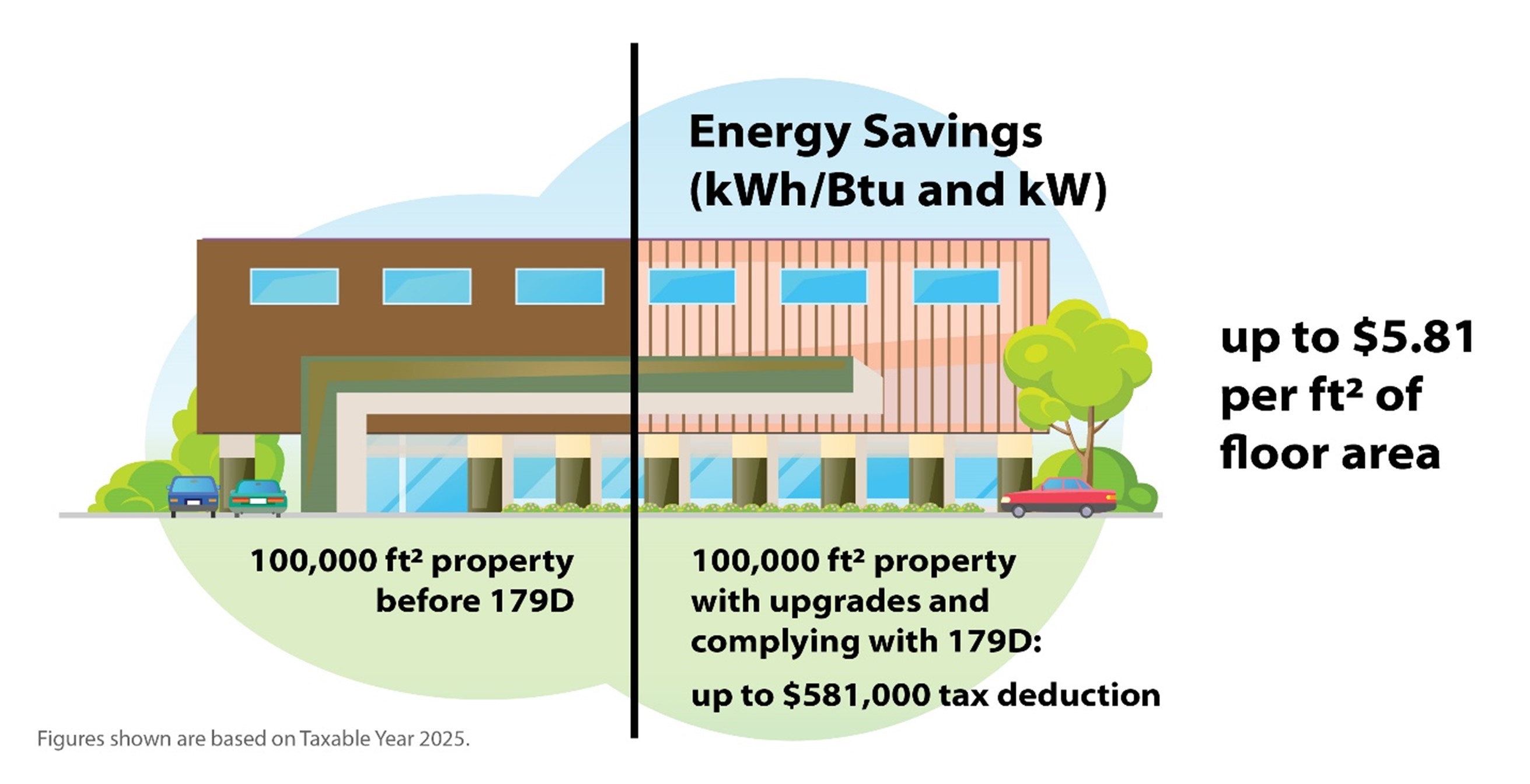

To be eligible for a tax deduction through either pathway, at least 25% savings must be achieved (modeled total annual energy and power cost savings for the Traditional [Modeling] Pathway, and measured site energy use intensity savings for the Alternative [Measurement] Pathway) for property installed in 2023 and after. The deduction amount increases as savings increase. Tax deduction amounts are listed below and are the same for both the Traditional (Modeling) and Alternative (Measurement) Pathways. These amounts may increase in future years based on inflationary updates, and can be found in the IRS Online Bulletins.

| PROPERTY MEETS ONLY 179D ENERGY CRITERION | PROPERTY MEETS ALL 179D CRITERIA (ENERGY, PREVAILING WAGE, AND APPRENTICESHIP) | |

|---|---|---|

| Taxable Year 2023 | Deduction Amount ($/ft2) $0.50–$1.00 Savings increase $0.02 for each percentage point of energy savings above 25% up to a maximum of $1.00. | Deduction Amount ($/ft2) $2.50–$5.00 Savings increase $0.10 for each percentage point of energy savings above 25% up to a maximum of $5.00. |

| Taxable Year 2024 | Deduction Amount ($/ft2) $0.57–$1.13 Savings increase $0.02 for each percentage point of energy savings above 25% up to a maximum of $1.13. | Deduction Amount ($/ft2) $2.83–$5.65 Savings increase $0.11 for each percentage point of energy savings above 25% up to a maximum of $5.65. |

| Taxable Year 2025 | Deduction Amount ($/ft2) $0.58–$1.16 Savings increase $0.02 for each percentage point of energy savings above 25% up to a maximum of $1.16. | Deduction Amount ($/ft2) $2.90–$5.81 Savings increase $0.12 for each percentage point of energy savings above 25% up to a maximum of $5.81. |

How the savings are calculated is different for the two compliance pathways. These differences are discussed in the section, Compliance Pathways for 179D.

Savings Requirements and Tax Deduction Rates

Savings requirements for both compliance pathways are summarized below.

| COMPLIANCE PATHWAY | TRADITIONAL (MODELING/EECBP) | ALTERNATIVE (MEASUREMENT/EEBRP) |

|---|---|---|

| Calculation Approach | Modeling | Measurement |

| Property Eligibility | New Construction or Building Upgrade | Building Upgrade Only* |

| Savings Metric | Modeled energy and power cost savings [%] for HVAC, SHW and interior lighting systems | Measured site energy use intensity savings [%] |

*A building must have been placed in service not less than 5 years before the establishment of the qualified retrofit plan (QRP) for the project to be eligible for a deduction based on the Alternative (Measurement) Pathway.

There is no longer a Partially Qualifying Property Pathway or Interim Lighting Rule, and the lifetime maximum deduction amount has changed to a 3–4 year maximum deduction amount for property placed in service after Dec. 31, 2022. Additional information about each pathway is described in detail in the section, Compliance Pathways for 179D.

About the Tax Deduction Amounts

The minimum requirement is 25% savings from the baseline. For projects that follow the Traditional (Modeling) Pathway, the savings are based on the annual energy and power cost difference between the taxpayer building model and the reference building model. For projects that follow the Alternative (Measurement) Pathway, the savings are based on the measured site energy use intensity of the building before and after the energy efficient buildings upgrades.

The tax deduction amount for both pathways increases five fold when projects meet additional 179D criteria as statutorily defined: (1) prevailing wage requirements, and (2) apprenticeship requirements. For more information, please refer to the IRS rule on PWA requirements.

For taxable year 2023, and for both pathways, an otherwise-qualifying project following these additional prevailing wage and apprenticeship requirements will qualify for a minimum tax deduction rate of $2.50/ft2 at 25% savings (energy and power savings for the Traditional [Modeling] Pathway or the measured site energy use intensity for the Alternative [Measurement] Pathway). The maximum tax deduction rate is $5.00/ft2. A project that does not meet the prevailing wage and apprenticeship requirements but otherwise meets the requirements of 179D will qualify for a minimum tax deduction rate of $0.50/ft2 and a maximum tax deduction rate of $1.00/ft2.

Please see the table above for inflationary updates for tax years 2024 and 2025. The tax deduction amount (tax deduction rate × building square footage) is capped at the cost of the energy efficient property placed in service, and also limited to the amount over the aggregate deductions for the prior 3 years (4 years for an allocated deduction), and subject to additional limitations as statutorily defined.

When taking the 179D deduction, the tax basis of the energy efficient commercial building property (i.e., the upgrade) must be reduced by the amount of the deduction (IRC Section 179D(e)).

Who Can Claim the Deduction?

This applies to both the Alternative (Measurement) and Traditional (Modeling) Pathways.

This applies to both the Alternative (Measurement) and Traditional (Modeling) Pathways.

- The taxpaying entity who owns the eligible property placed in service.

- The designer (the person primarily responsible for designing the eligible property placed in service), when a specified tax-exempt entity elects to allocate the tax deduction to that person instead of claiming it as the building owner.

Specified tax-exempt entities are:

- The United States, a state or its political subdivision, a U.S. territory, or any agency or instrumentality of the foregoing.

- A Tribe or Alaska Native corporation, as statutorily defined.

- Any organization exempt from tax under Subtitle A, Chapter 1 of the Internal Revenue Code.

What Types of Buildings and Projects Are Eligible?

To be eligible, energy efficient property must be placed in service on or in a building that meets the requirements as statutorily defined. For the Traditional (Modeling) Pathway, the building must be located in the United States and within the scope of ASHRAE Reference Standard 90.1 Appendix G (See section, Selection of Reference Building Energy Standards, for the applicable version).

The project can be either:

- New construction with eligible energy efficient property placed in service.

- Building upgrade with eligible energy efficient property placed in service as part of the upgrade.

There are two compliance pathways for projects. Details of each compliance pathway can be found in the section, Compliance Paths for 179D.

What Types of Energy Efficient Property Are Eligible?

Energy efficient property installed as part of the following building systems may be eligible to claim this deduction:

Energy efficient property installed as part of the following building systems may be eligible to claim this deduction:

- Interior lighting

- HVAC

- Hot water (service water heating)

- Building envelope.

This applies to property placed in service as part of a new construction or building upgrade project. Other energy efficient processes or equipment loads are not eligible.

Compliance Pathways for 179D

There are two 179D compliance pathways:

- The Traditional (Modeling) Pathway, which can be applied to both new construction and building upgrade projects for eligible buildings.

- The Alternative (Measurement) Pathway, which can be applied to buildings originally placed in service at least 5 years before the establishment of the qualified retrofit plan for the project and requires energy use data before and after the building upgrades.

These pathways differ in terms of the methodology for evaluating the impact of energy efficient property. The Traditional (Modeling) Pathway utilizes building energy simulation tools to determine project savings compared to a reference building energy model, and the Alternative (Measurement) Pathway uses energy consumption data before and after eligible energy efficient equipment is placed in service to document performance improvements.

The figure below highlights the commonalities and differences between the two pathways.

Traditional (Modeling) Pathway

New construction and building upgrade projects may pursue the Traditional (Modeling) Pathway, through which energy modeling is utilized to evaluate the impact of eligible EECBP compared to the performance of a reference building model (i.e., a building energy model created based on the requirements of ASHRAE Standard 90.1 Appendix G. See section, Selection of Reference Building Energy Standards, for the applicable version).

The savings metric for the Traditional (Modeling) Pathway is the simulated annual energy and power cost savings associated with the installed building envelope, HVAC, hot water (service water heating), and/or interior lighting property.

Eligible property placed in service via the Traditional (Modeling) Pathway, whether as part of a new construction or building upgrade project, is referred to in the statute as EECBP.

Qualified Software for 179D is used to model systems and buildings conforming to the requirements of the 179D Traditional Pathway tax deduction. The U.S. Department of Energy (DOE) has a new estimation tool, allowing users to estimate energy and cost savings for a subset of building types with certain building characteristics without having to create a new building model for each building. Any information generated by the 179D Portal is solely for the purpose of creating an estimate and cannot be relied upon to establish any requirement of section 179D, or for any purpose in claiming the 179D deduction.

There is no longer a Partially Qualifying Property pathway, or the Interim Lighting Rule. For Traditional (Modeling) Pathway resources related to taxable years prior to 2023, see 179D for Taxable Years Prior to 2023.

Overview of the 179D Traditional (Modeling) Pathway Process

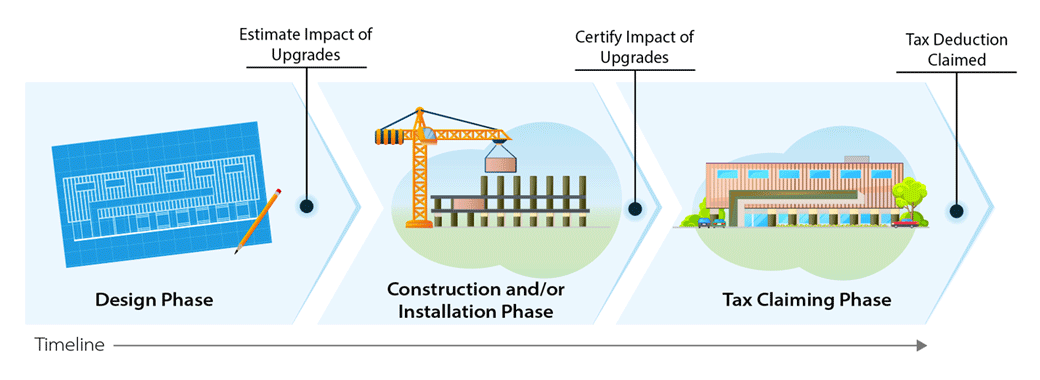

To claim a tax deduction through 179D, a building owner should first consider the specification of eligible energy efficient property during the planning and design phase of a new construction or building upgrade project. This includes equipment replacement for building upgrades.

For the Traditional (Modeling) Pathway, the associated energy efficiency impact is quantified using building energy modeling during the design phase. The figure below outlines the process.

Energy Savings Modeling and Inspection Guidelines for Commercial Building Federal Tax Deductions for Buildings, published by the National Renewable Energy Laboratory (NREL), provides guidelines for the modeling and certification of energy savings required by the statute.

Please visit the Frequently Asked Questions webpage for more information on the Traditional Pathway.

When to Apply for 179D

Projects following the Traditional (Modeling) Pathway must have the eligible energy efficient property placed in service certified by a qualified individual as reducing certain annual energy and power costs.

Projects following the Traditional (Modeling) Pathway must have the eligible energy efficient property placed in service certified by a qualified individual as reducing certain annual energy and power costs.

The date when the property is placed in service and the associated taxable year are important for determining a project's deduction rates and other program rules.

To find more about the history of 179D and other incentives for high-performance buildings, please reference the Resources section.

Selection of Reference Building Energy Standards

When the energy modeling pathway is selected, reference building energy standards must be selected to create appropriate building energy models for (1) before and (2) after the upgrades. The table below includes the criteria for selecting appropriate reference standards to define building energy model parameters, as defined in Announcement 2024-24 or any guidance that supersedes this announcement.

| CONSTRUCTION BEGIN DATE | BUILDING/UPGRADES PLACED IN SERVICE | BUILDING ENERGY MODELING METHODOLOGY RESOURCE |

|---|---|---|

| Construction Began Before Jan. 1, 2023 | Not applicable | ANSI/ASHRAE/IES Standard 90.1-2007 2005 Title 24 Alternative Calculation Method (ACM) Reference Manual |

| Construction Begins on or After Jan. 1, 2023 | Date placed in service before 1/1/2027 | |

| Date placed in service after 12/31/2026 and before 1/1/2029 | ANSI/ASHRAE /IES Standard 90.1-2019, Title 24 Alternative Calculation Method (ACM) Reference Manual (version TBD) |

Alternative (Measurement) Pathway

For the Alternative (Measurement) Pathway, the building must (1) be located in the United States and (2) have been placed in service not less than 5 years before the establishment of the qualified retrofit plan (QRP) for the project. The QRP is prepared to document planned upgrades and their projected impacts, and then the impacts of those upgrades are quantified using measured site energy consumption after project completion. The modifications to the building in the aggregate must reduce the building's energy use intensity by 25% or more. Eligible property placed in service via the Alternative (Measurement) Pathway is referred to in the statute as EEBRP.

Measured energy use intensity data, adjusted to take into account weather, before and after the building upgrade are required to determine the tax deduction rate. As statutorily defined, building upgrade projects following the alternative compliance pathway must certify (1) pre-upgrade site energy use intensity as of any date during the 1-year period ending on the date the eligible property is placed in service, and (2) post upgrade site energy use intensity as of any date more than 1 year after the date the eligible property is placed in service.

To create an estimated potential deduction amount for placing in service EEBRP, please visit DOE's new estimation tool. Any information generated by the 179D Alternative Pathway tool is solely for the purpose of creating an estimate, and cannot be relied upon to establish any requirement of section 179D, or for any purpose in claiming the 179D deduction.

Resources

2024

Updated Reference Standard 90.1 for § 179D

2023

Internal Revenue Bulletin 2023-03

2022

Internal Revenue Bulletin 2022-52

Internal Revenue Bulletin 2022-47

Internal Revenue Bulletin 2022-45

Internal Revenue Bulletin 2022-43

Internal Revenue Bulletin 2022-07

2021

Internal Revenue Bulletin 2021-48

2020

Internal Revenue Bulletin 2020-40

2019

Internal Revenue Bulletin 2019-48

2018

Internal Revenue Bulletin 2018-22

2017

Internal Revenue Bulletin 2017-18

2016

Internal Revenue Bulletin 2016-21

2015

Internal Revenue Bulletin 2015-49

Internal Revenue Bulletin 2015-05

Internal Revenue Bulletin 2015-02

2014

Internal Revenue Bulletin 2014-36

2013

Internal Revenue Bulletin 2013-43

2012

Internal Revenue Bulletin 2012-41

Internal Revenue Bulletin 2012-28

Internal Revenue Bulletin 2012-17

Internal Revenue Bulletin 2012-14

2011

Internal Revenue Bulletin 2011-37

Internal Revenue Bulletin 2011-18

Internal Revenue Bulletin 2011-04

2008

Internal Revenue Bulletin 2008-14

2006

179D Commercial Building Tax Deduction - Frequently Asked Questions

Improving Equitable Access to Energy-Efficient Commercial Building Tax Incentives, ACEEE (2024)

Market Transformation Through Expanded Impact of 179D Tax Deduction, ACEEE Summer Study on Energy Efficiency in Buildings, ACEEE (2022)

Energy Savings Modeling and Inspection Guidelines for Commercial Building Federal Tax Deductions for Buildings, NREL (2016)

ENERGY STAR® Portfolio Manager®

An overview of Portfolio Manager

Portfolio Manager quick start guide

How to set up your property in Portfolio Manager

How to get utility data into Portfolio Manager